Harding to speak on ME conflict at Exile's Intel Day on 9 March

The amplifying geopolitical instability in the Middle East has significant implications for the project, export and commodity finance...

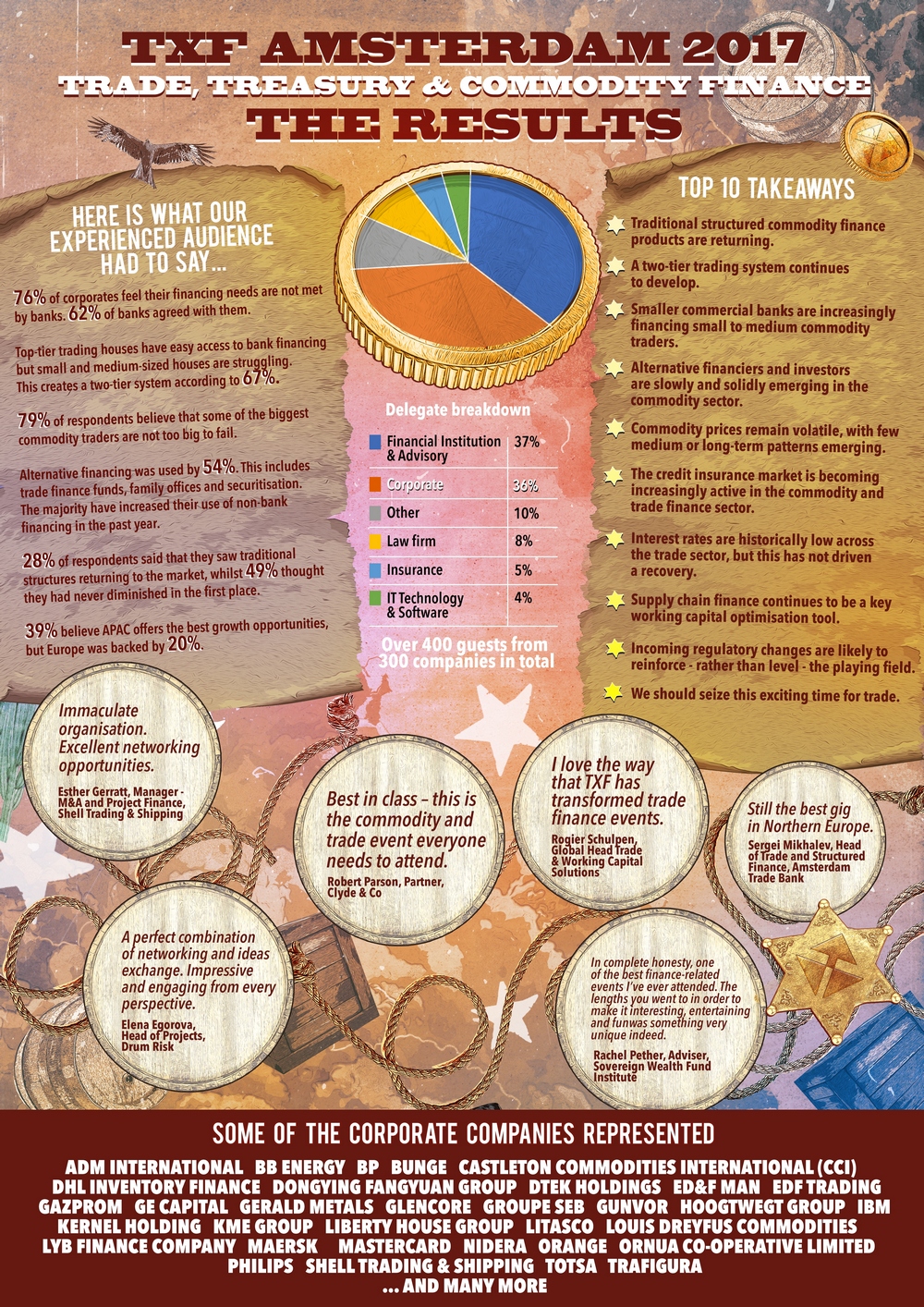

Straight from the horse's mouth...

No one puts it better than the speakers and guests who've joined us all around the world for our commodity, trade & treasury events. We thank them for their kind words and hope you enjoyed this one as much as they did!