Outlook 2015 | Mildly optimistic after a shaky start

World trade grew at around 1.2% during 2014. This is still a forecast but is based on the actual data from the International Monetary Fund for the first three quarters of 2014 and the Delta Economics forecast for Q4 2014.

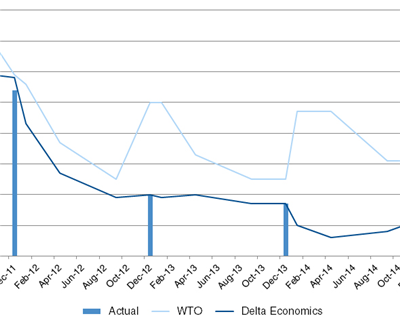

World trade grew at around 1.2% during 2014. This is still a forecast but is based on the actual data from the International Monetary Fund for the first three quarters of 2014 and the Delta Economics forecast for Q4 2014. The Delta Economics forecast aligns with the CPB Netherlands Bureau Trade Monitor for the first three quarters of 2014 but is divergent from the ~IMF^ and WTO’s trade forecast for 2014 by some margin (Figure 1).

Delta Economics is predicting that World trade will grow in value terms slightly during 2015 from 1.2% to just below 2% by the end of 2015. Because this is a forecast in constant values, it represents likely increases in World trade volumes during the course of the year.

Care should be taken in interpreting this growth, however. While it is the first forecast of slightly faster growth that we have made since 2011, it is still too slow to suggest that there is any major resurgence of trade as a driver of economic growth or, indeed, a return to the multiples of trade growth versus GDP that was evident in the immediate aftermath of the financial crisis.

Figure 1 | Delta Economics, WTO forecasts versus actual trade growth, 2011-14

Source | Delta Economics, WTO and CPB Netherlands Bureau 2011-14

The growth in 2015 will be led by two regions, Asia and North America (Figure 2). Asia’s growth, to a large extent will be driven by:

- China’s recovery from slow trade growth (at just 4%) in 2014 to above 7% in 2015, although this is still a long way below post-crisis peaks

- Re-distribution of trade around the region away from China, we expect particularly rapid trade growth in Indonesia and Malaysia at over 10% and 7% respectively in 2015

North America’s growth is driven by exports which, following a sustained period of re-shoring, are forecast to grow by nearly 4.5% in 2015.

However, every other region’s trade is forecast to decline or grow at a slower rate in 2015 with Europe’s trade set to shrink in current prices by 3.5%. Much of this is due to declining intra-European trade: trade within the Eurozone is forecast to drop by 3.7% this year reflecting weak demand conditions within the Eurozone.

Figure 2 | World and regional trade growth (% constant prices), 2014 and 2015 compared

Source | DeltaMetrics 2014

Disinflation, oil prices and the risks of contagion | MENA’s trade is forecast to drop to 1.9% in 2015 from an already disappointing 3.6% growth in 2014. At the beginning of 2014 the Delta Economics forecast was for above 4% growth. On paper at least, oil producing nations are net losers in export terms as the oil price drops while oil importers are net winners in that it reduces costs for producers and exporters.

A zero-sum game in trade terms as the oil price drops is over-simplistic, however. Trade and oil are 94% correlated. This means that trade can effectively be a mechanism through which disinflation is spread through the global economic system. Emerging markets are the largest oil producers and, as they lose export revenues, their aggregate demand falls back meaning that they demand less by way of imports from other countries. Lower oil prices reduce producer costs, but if there is little demand either within or outside of a region then export prices will also have to drop.

Against this backdrop the forecast for World trade becomes important as a predictor of when we might see oil prices increasing again (Figure 3).

The monthly predictions of trade growth suggest that there will not be any major pick-up in the oil price until the end of Q1 2015. Even then, any increase will be erratic and relatively small based on how we are predicting global trade will grow.

Figure 3 | Monthly value of World trade vs. NYSE Arca oil spot, Last Price Monthly, June 2001-Nov 2011

Source | DeltaMetrics 2014, Bloomberg

Geopolitics, geoeconomics and “febrile stability” | 2014 was dominated by geo-political and geo-economic risks from the outset: starting with the Emerging Markets in January, Russia and Ukraine in late February, the Iraq crisis in June 2014 and subsequent crises in August to the end of tapering, with China and Japan’s economic slowdowns at the end of the year. Until the major fall in oil prices at the end of 2014, markets appeared to be pricing these in. Equity markets continue their bull run with the role of central banks increasingly seeming to be to provide reassurance to markets that nothing precipitous is likely to happen to interest rates in the immediate future.

This creates what Delta Economics terms, “febrile stability”: markets are behaving as if there are no underlying geo-political or geo-economic concerns, yet watching for one incident that will trigger a major sell-off.

The case of Germany’s car trade with China and Russia illustrates the interplay between geo-politics and geo-economics and its dampening effect on trade (Figure 4). The DAX is 86% correlated with Germany’s trade overall, 73% correlated with its car trade to China and 84% correlated with its car trade to Russia. Figure 4 shows:

- German car exports to China are forecast to grow during 2015 but it will not be until the end of Q2 that exports really pick up again, this suggests that China’s demand for luxury goods, while growing, is not growing at the pace that might be expected

- German car exports to Russia are forecast to slow during 2015 and have dropped substantially since the beginning of the Russia-Ukraine crisis, this is partly a reflection of Russia’s weakening economy but in the first instance was the result of punitive reciprocal trade restrictions

The tipping point in 2015 is likely to be an increase in interest rates in the USA. If this is early in 2015 while oil prices are still falling, this will further strengthen the US Dollar, reducing further the export revenues for emerging economies in particular and placing at risk of default any sovereign debt or bonds denominated in US Dollars. As Russia, Argentina and Venezuela are close to default this could be the catalyst that sparks a global correction.

Figure 4 | Monthly value of German car exports to Russia and China, USDm vs. DAX, Last Price Monthly (June 2001-Dec 2015)

Source | DeltaMetrics 2014, Bloomberg

Global equity markets long overdue a correction | Delta Economics modelling continues to suggest that equity markets are long overdue a correction. The correlation between World trade and the S&P 500 has weakened from 68% in January to 62% now and this reflects its long bull run that has extended to the end of 2014. It has become increasingly detached from real macroeconomic indicators and increasingly determined by central bank monetary policy and short-term sentiment indicators.

Delta Economics considers the bull run to be unsustainable given the pressures of disinflationary contagion and geo-political and geo-economic risk that spread through the global trade system. Economies do not operate in isolation in the same way as they did pre-crisis and a hike in interest rates in one country, particularly the USA, will impact others through trade and debt dependencies. Against this fragile backdrop, it is likely that a major correction in asset prices will take place during 2015.