Part 2: TXF-ICC Global Export Finance Survey 2017

The second instalment of the TXF-ICC Global Export Finance Survey 2017 – which complemented the ICC’s 2017 Rethinking Trade & Finance report – incorporates the more general market trends witnessed by 100 senior export finance practitioners at leading banks, ECAs, and exporters and importers. Again, the results will surprise.

In the second instalment of the TXF-ICC Global Export Finance Survey participants were given the chance to answer some more general questions on the top products, sectors and regions in the market over the past year, as well as citing the most prohibitive factors in doing export finance deals in new markets.

62% of respondents were involved in at least as many deals in 2016 as in 2015. This growth was generally modest with 29% of respondents seeing their deal activity rise by 1-20%. A very small number, however, (3%) were involved in at least twice as many export deals in 2016 as in 2015.

On the other hand, a very sizeable minority of 38% saw a decrease in activity, although for 65% of those, the decrease was one of less than 20%.

Generally, then, while there are more practitioners experiencing growth, the uneven distribution of growth and prominence of business decline for a significant section of the market suggests a competitive landscape which is yielding both winners and losers.

Legal worries curtailing growth into new markets

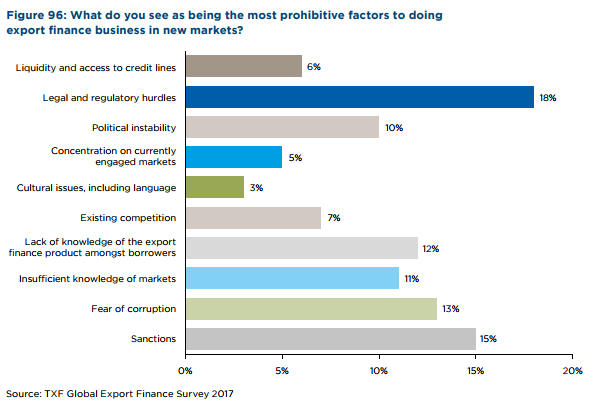

When asked about the most prohibitive factors to doing export finance deals in new markets, legal issues were cited as a top concern. A third of respondents felt that one of their three biggest hurdles in that regard were either regulatory requirements (52%) or sanctions (42%). Both of these issues have a degree of fluidity, so the challenge remains for market respondents to adopt stable internal mechanisms for managing them. In comparing responses this year with last year’s, it appears the industry has not successfully done this and the compliance landscape continues to be a burdensome one: in last year’s survey, 40% of respondents struggled with legal and regulatory hurdles (versus 52% this year).

Corruption also figured highly, with 36% citing it as one of their main barriers. Given export finance is a tool to designed to make possible business that may not otherwise go ahead, this is thus unsurprising given the risk profile of some of the markets it is present in.

Gaps in knowledge were also significant among both corporates and financiers. 30% of participants felt that a lack of knowledge of new markets was holding them back from doing business there, while 35% worried most about prospective borrowers’ understanding of the export finance product. The proliferation of the ICC Working Group on Export Finance, inter alia, could help to combat this by better harmonising and marketing the product to potential users.

Other issues, including political instability, competition, access to credit lines and liquidity and cultural issues were found to be smaller concerns. On political instability, this is a big move from last year, when it was identified as a key deterrent by 43% of respondents.

Power and infrastructure come out top

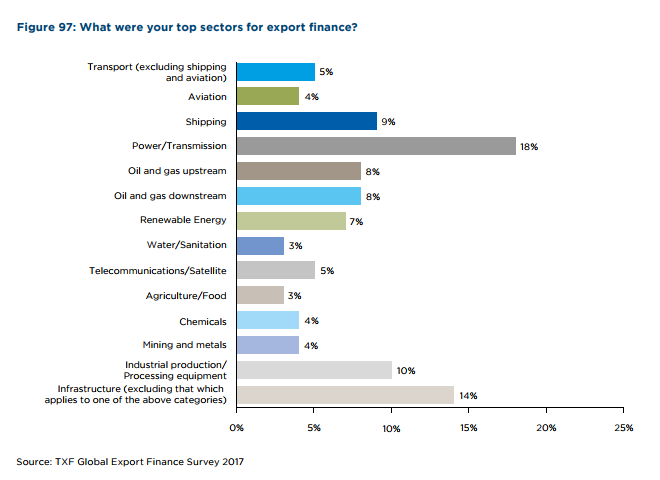

Power and infrastructure were particularly active sectors of the export finance market, figuring in the top 3 sectors for 18% and 14% of respondents, respectively. Despite recent concerns about the shipping industry, it still figured fourth in the list, with 9% of respondents citing it as a key sector. Oil and gas upstream and downstream were both cited as a top sector by 8% of those surveyed. However, renewable energy came up close behind at 7%, indicating the growing activity in the renewables sector, perhaps bolstered by recent limits on the development of new coal fired power plants.

The future trajectory of renewables is now under particular scrutiny as the road ahead for the Paris Agreement is debated. Nonetheless, with emerging powers such as India pushing on determinedly towards non-fossil fuels sources, it looks to be a sector that will enjoy considerable growth.

Americas providing ample opportunity

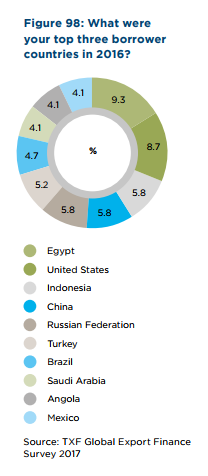

Egypt was the top borrower market for 2016, as the country continues its push to meet its vast energy needs and the government of Abdel Fattah el-Sisi continues to receive backing from international partners. More power deals have been done in the country and that trend is expected to continue.

Despite the travails of its own ECA – US Ex-Im – the USA came in second as borrower market, reinforcing the fact that export finance is not a product used only for exporting into emerging markets. The Americas as a whole provide significant opportunities to exporters and financiers, with Brazil and Mexico also figuring in the list of top borrower markets.

Other popular destinations included Indonesia, Russia, China and Turkey.

A holistic view of the export finance solutions

A dominant message that has surfaced from previous iterations of this survey was the extent to which export-finance was a round-the-cycle solution that was predicated on strong relationships. With this in mind, this year’s survey set out to build on that finding and understand further how banks position and view the product internally, and what broader bearing it has on their relationship with clients.

Firstly, when asked to consider the export finance product offering in its totality, bankers almost unanimously agreed (97%) that it benefited their financial institution’s commercial relationship and customer intimacy. This positive enhance of the client relationship is supplemented by a second strong finding, which is that the export finance solution helps to secure repeat business (90%).

One area of potential concern, however, is the mixed feeling respondents had towards export finance being a factor of complexity and delays. Three-quarters of respondents stated that they either agreed or were neutral on the assertion that complexity and delays were a feature of export finance, adumbrating the industry’s needs to continue to try and find ways to speed up and simplify the process.

“What a bank wants”: In ECA partners

Consistency – which in turn fosters predictability and leads to more effective planning – and flexibility are the key features that banks value when dealing with an ECA. 60% of respondents stated that these two factors were ‘extremely important’, with the latter being most helpful in the form of ECA flexibility on the question of terms and structures. Given a more rigid approach has the potential to preclude deals, the industry collectively faces a balancing act between a well-understood product offer that is consistent and predictable, without sacrificing the flexibility that allows it to pivot in different directs to help get transactions over the line.

Interestingly, the least important factor was commercial support - with 10% stating it was not important at all and over half claiming it to be a neutral factor. This suggests either: 1) A feeling of a strong commercial position among banks at present, or 2) The delineation of an ECA’s role as being other than to provide commercial support.

On the whole, working relationships between banks and ECAs appear to be in a very good state. The vast majority of banks believe that they have a forward-looking relationship with each of the ECAs that they are most actively cooperating with, for example on matters of sharing upcoming commercial opportunities, key markets, and working together in advance of transactions being secured. While this is certainly a healthy dynamic for the export finance sector, it should be noted that despite these strong relationships, it is still the exporter or importer that drive business and thus often determine the make-up of the bank and ECA in any given transaction.

“What a bank wants”: In product and innovation

When it comes to products and innovation, structure flexibility (90%), the quality of the guarantee (85%), and claims procedure & track record (also 85%) were identified as either extremely important or fairly important features for banks, collectively reflecting the appeal of a strong, secure, backed-up deal.

The least important feature was an ECA’s direct lending capabilities with a fifth of respondents claiming it to be not important at all and 60% claiming it to be a neutral factor, corroborating the aforementioned inference of how banks view the primary roles and offerings of ECAs.

When respondents were asked to rate their top ECA on the same range of factors, the highest and lowest ratings broadly mirrored the most and least important features identified, with quality of guarantee ranking extremely well and direct lending capability ranking relatively poorly. Effectively, there appears to be a consensus that the ECAs are doing better on those parameters where banks would consider their support to be most valuable.

The strive for a level playing field

Several respondents – from banks and non-banks alike – wish for the export finance product to be simplified. Among the top concerns cited were overly complex documentation, the need to level the playing field between ECAs operating in various countries and overly stringent (and at times contradictory) regulation. These concerns were expressed by banks and non-banks in fairly equal measure. Others’ wishlists included revisions to stringent rules on local content to better reflect a globalised world, a full board for US Exim, and more standardised documentation.

Linked to this was a feeling that the product is not understood by non-specialists. One bank respondent wished for “better understanding of what we do from C-suite management,” while several others felt that financial regulators did not understand the low-risk nature of export finance.

Key challenges remain

Banks’ views are all fairly well aligned when it comes to key challenges in the industry: almost all respondents were worried by: stringent regulation; unmanageable Know-Your-Customer (KYC) and Anti-Money Laundering (AML) requirements; and excess liquidity coupled with a lack of bankable deals, leading to fierce competition and unsustainable low pricing.

These concerns, however, were not clearly echoed among non-banks. For those parties, the most pressing issue was a shortage of projects and high competition for the projects that are available. Other concerns cited included: insufficient cooperation between multilateral financial institutions (MFIs) and other market players; the industry’s inability to effectively serve small and medium-sized enterprises (SMEs); and insufficient product knowledge.

On a more positive note…

There was plenty for the industry to be optimistic about. Many banks were positive about new technological tools which will surely help address the aforementioned concerns about the complexity of the export finance product and the lack of standardisation. Many are also continually enthusiastic about growing in new markets and sectors, with one citing enjoyment in being part of a “global business with diverse cultures and new experiences.” This enthusiasm was shared among non-banks, who find satisfaction from “Enabling projects that make a material difference to the economies in which they are developed” and being part of an industry where “every deal is different, with new players and new structures.”