Pricing perceptions: TXF-ICC Global Export Finance Survey 2017

The TXF-ICC Global Export Finance Survey 2017 – which complemented the ICC’s 2017 Rethinking Trade & Finance report – incorporates the pricing and liquidity views of 100 senior export finance practitioners at leading banks, ECAs, and exporters and importers. The results will surprise.

Given pricing is a core factor in profitability, and therefore instrumental to the outlook of an export finance solution on which many corporates rely, this year's survey gathered the industry’s view on patterns in, and drivers of pricing.

Two thirds of respondents cited a decrease in pricing over the last year: 27% of respondents saw a drop by 11-20%, 26% cited a decrease of 1-10%, and 10% claimed pricing had decreased by more than 20%.

24% said pricing had stayed the same, while the remaining 13% cited an increase between 1-10%. The low pricing environment is a serious rejoinder to expectations set out in the previous year’s survey, when nearly half of respondents said they expected it to go up.

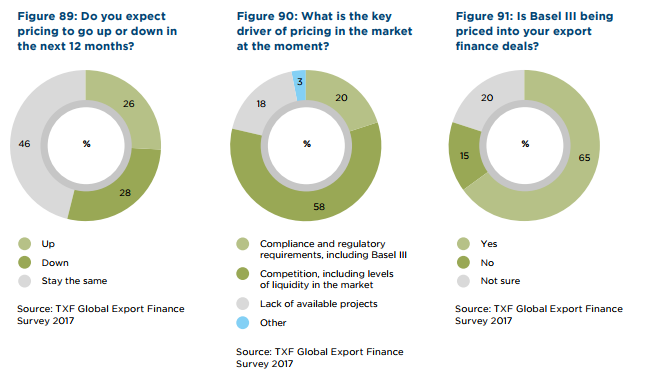

This time, when asked whether pricing would go up or down in the next 12 months nearly half (46%) of respondents said it would stay the same, 28% said there would be a decrease, with the remaining 26% citing an increase in pricing.

Low pricing will be a serious issue for many bank practitioners specifically, who may be able to weather a short-term situation of this kind, but for whom a longer term trend of low pricing may become unsustainable.

Over half of respondents (58%) claimed the key driver of pricing was competition, including levels of liquidity in the market, while a fifth of respondents cited compliance and regulatory requirements, including Basel III. The low interest rate environment externally has driven a stronger interest in trade finance as an asset class, and thus these larger pools of liquidity could have led to downward pricing pressures.

Non-bank respondents were more likely to identify compliance and regulation requirements as a driver of pricing than banks were, suggesting a perception issue. The remaining 18% said a lack of available projects was a key determinant of pricing.

When asked specifically about Basel III being priced into export finance deals, two thirds (65%) of respondents concurred. This is a 6 increase on last year, a reassuring trajectory that is likely to continue as we move towards Basel III implementation deadline. Nonetheless, 15% reported that Basel III was still not being priced into transactions and 20% were unsure.

When looking at responses of non-banks only, a third were unsure as to whether Basel III was being priced into their export finance deals. While this is likely to be because banks want to manage their ‘under-the-bonnet’ requirements internally, it does leave open the possibility of greater discussions between banks and clients about regulation and further impacts moving forward.

The intersection of pricing and direct lending

The consensus across banks and non-bank respondents was that while ECA direct lending occasionally treads on the toes of the private market, it can also complement bank lending. Moreover, it can influence the key issue of pricing discussed above. Respondents observed that the availability of CIRR for small size or challenging jurisdictions can often drive a deal to direct lending.

Bank respondents commented that ECA direct lending caused competition problems, especially if direct lenders entered the presently well-engaged markets. The overwhelming sentiment is that ECAs should only offer direct lending as a last resort where bank capacity is not available, or to help provide supplementary funds for project finance transactions in difficult markets, thus making it more useful than a competitive threat.

The direct lending question is also important because it helps to adumbrate how the export finance business with banks is evolving, with many now focusing more efforts on arranging and structuring, expertise that ECAs cannot so readily compete with.

The main threats commercial banks perceived were of being crowding out in a limited supply market, alongside the aforementioned slight difference in pricing with the current record low CIRR.

The low CIRR rate will have marginally contributed to the decrease in pricing witnessed over the past year, as more players opt for the cheap ECA funding option, and in turn, banks drop their margins to compete. For example, HEXIM and EDC last year co-financed PLN’s development of eight GE-supplied mobile power plants. The 12-year $436 million debt was priced at a fixed CIRR rate of 2.56%.

At present, qualitative responses to the survey suggest respondents do not feel ECA direct lending is being substantially used in favour of SME financing, where it could close a market gap. Instead, it has absorbed.

This compounds issues for SMEs, in a market in which only 47% of respondents believe is doing enough to support SMEs. The reasoning for this varies from the cost and complexity of the tool to a belief that it is not the primary role of ECAs to support this market segment. It is a challenge that is being tackled across trade finance, from short to long term financing, and which can be propelled by new solutions being found in digitisation, simplification and harmonisation.

Fee decrease broadly in sync with pricing

The majority of respondents saw a decrease in bank fees over the past year: 28% cited a 1-10% decrease, 17% claimed fees decreased by 11-20%, while 9% saw a decrease of more than 20%.

13% cited a rise in fees by 1-10% and 4% said the increase had been between 11-20%.

Only 11% of banks reported an increase of any kind in bank fees, compared with around 30% of non-bank respondents. This tightening of fees comes despite an increase in prohibitive factors, some of which are delineated below.

Check out the full ICC 2017 Rethinking Trade & Finance report here.