CGIF: Nurturing greenfield project bonds

Construction risk has long been an impediment for the use of project bonds to finance greenfield infrastructure projects. The Credit Guarantee and Investment Facility (CGIF) recently introduced an innovative solution to mobilise long-term savings in local currencies in developing Asia to finance greenfield infrastructure projects through project bonds.

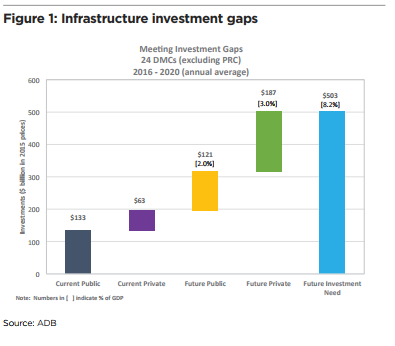

Developing Asia, like other emerging economies, faces a daunting challenge to meet its huge infrastructure investment needs. Developing Asia will need to invest $26 trillion from 2016 to 2030, or $1.7 trillion per year, in order to maintain the region’s growth momentum, eradicate poverty, and respond to climate change, according to the Asian Development Bank (ADB)’s latest forecast. To meet this challenge, private sector participation is now more crucial than ever. The ADB estimates private sector financing in 24 Asian developing countries will have to increase from $63 billion a year today to $250 billion a year during 2016-2020 to fill this gap.

Furthermore, a bulk of private sector financing will need to come in local currencies to avoid the currency mismatch, because many of the infrastructure projects rely on local currency revenues to pay back their debt. Even when foreign currency indexation mechanisms are available for revenue streams, the sustainability of such mechanisms is questionable in the event of a currency crisis, as some Asian countries learned the hard way during the Asian financial crisis in the late 90s. The real solution should be to fund infrastructure investment in local currencies.

CGIF is a new multilateral institution established by 13 Asian countries comprising of all ten member countries of the Association of Southeast Asian Nations (ASEAN), and their ‘Plus 3’ partner countries which are China, Japan and Korea, together with the ADB to help overcome these challenges. The CGIF provides guarantees to local currency bonds issued by corporates and projects mainly in the ASEAN countries to help facilitate their access to bond markets.

While the CGIF can support corporates or projects in a wide range of sectors/industries, its guarantee support is particularly useful for infrastructure projects. This is because one of the solutions to overcome the challenges above is to facilitate the channeling of domestic long-term savings in emerging economies to finance infrastructure projects directly via project bonds, particularly at the greenfield stage. On the back of steady economic growth, and the rise of income levels with growing middle income population, many ASEAN countries are now witnessing rapid accumulation of local currency long-term savings in their pension and insurance funds. These long-term savings invariably need long-term investment opportunities, and the stable cash flows of infrastructure projects would be ideal for them.

The CGIF has been working with the ASEAN governments, regulators, rating agencies and bond investors for several years to boost the flows of domestic currency funding into infrastructure projects in the ASEAN countries, in particular green-field projects. Mobilising long-term savings in pension and insurance funds in these countries may be the most efficient model of financing infrastructure by long-term local currency funds, only a few countries in the region have successfully pursued this capability. A critical impediment against mobilising long-term savings is the low risk appetite of pension and insurance fund managers and, in particular, their aversion to construction risks.

Construction Period Guarantee Facility (CPG)

The CGIF’s Construction Period Guarantee (CPG) facility is aimed at allaying domestic bond investors’ concerns about construction risks. It ensures the completion of construction works and the commencement of the operations phase in a project, which will be financed by project bonds issued in the local currency bond market in the region.

Under this facility, the CGIF irrevocably and unconditionally guarantees non-payment of scheduled payments for the project’s bonds occurring prior to the commencement of commercial operations. If a project’s completion is delayed, the CGIF shall ensure that the project bonds are adequately serviced on a timely basis. In the unlikely event that it cannot be completed, the CGIF shall accelerate the guaranteed bonds and pay in full the principal and accrued interest amounts to bondholders.

Generally, the CPG facility will cover the construction period as well as a reasonable buffer period to allow for possible delays in the project’s construction. Therefore, the tenor of the CPG facility is expected to be for a three to five year period or so at the outset, but if the construction is further delayed, the CPG cover will continue until the project meets the completion milestone. Depending on the nature of the project (e.g. the initial ramp-up period is necessary before being fully operational) and investors’ requirements, the CPG facility could also be extended to cover the initial operation period until the project actually demonstrates its ability to generate stable cash flows. Such flexibility embedded in the CPG facility is important to address bond investors’ concerns about possible construction delays.

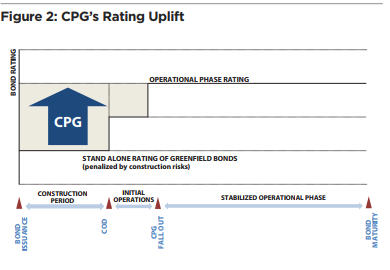

When the ratings agencies assess greenfield infrastructure bonds, their ratings can be seriously constrained by construction risks. This is despite the fact that the projects may have stable and robust cash flows during the operational period, and even though the construction period is far shorter than the operational period.

There are many elements of risks during the construction period which are highly complex to assess. The investors, therefore, need pricing of the bonds that ultimately reflects these risks. This generally makes bond financing for such deals economically unviable when the long-term bonds are priced considerably higher based on risks which are likely to be overcome in a relatively short period of time. By removing risks during the construction period entirely from the transactions, the CGP facility eradicates any rating penalties arising from such risks, allowing bond investors to focus only on the operational risks of the projects, and enabling lower fixed interest rates to be applied from the onset.

Changing project financing landscape in ASEAN

The CPG facility is anticipated to boost the use of local currency project bonds for new projects in the region by eliminating construction risks for bondholders investing in greenfield projects.

While local bank lenders in the ASEAN countries are liquid and usually very keen to finance infrastructure projects, even on a project financing basis often at attractive pricing, bond finance can bring certainty to project sponsors with fixed interest rates, which is a common feature of bond finance. Moreover, while local banks can lend for up to 12 years or so, bond investors can provide longer tenors of up to 20 years or even longer in some countries.

Stretching a finance tenor will improve the project’s economics and create room to reduce the tariff levels. Finally, project sponsors will be able to diversify their funding sources. This is especially vital to overcome single group exposure limits imposed on bank lending In the Philippines. For example, there are only a small number of leading domestic conglomerates engaged in a wide range of infrastructure projects, and single group exposure limits hinder the development of greenfield infrastructure projects. The CPG facility will unlock a great variety of benefits of bond finance to green- field infrastructure projects.

In the developed economies, major institutional bond investors such as global insurance companies and leading pension funds, have their own internal expertise and manpower to supplement the project finance banks in funding greenfield infrastructure projects. But in the emerging economies of the ASEAN, there is little internal capacity among domestic bond investors, such as pension and insurance fund managers. It will be very costly and time-consuming to develop expertise in-house.

The CGIF has developed a comprehensive assessment framework that allows these risks to be measured and managed. Components of this framework will allow for expert judgement of the various risk factors relating to the construction works as critical inputs in the assessment. Risks are also managed by the CPG’s boilerplate requirements for the various contractual agreements and risk mitigants that are consistent with international project finance practices.

While domestic bond investors in the ASEAN countries may first rely on the CPG facility, the CGIF plans to share its assessment tools with these bond investors. Replicating the CGIF’s assessment framework, they will become familiarised with the assessment of construction risks and will develop their own capacities in the future to understand, evaluate and mitigate construction risks to acceptable levels. This will allow them to invest in greenfield bonds independently even without the CPG’s support. If this happens, it will fundamentally change the landscape of project financing in the ASEAN countries. This may take some time but CGIF is committed to bring this change to the region.