Titan Mining closes US Ex-Im financing for Kilbourne project

The Export-Import Bank of the United States has signed an amended definitive credit agreement with Empire State Mines, making available...

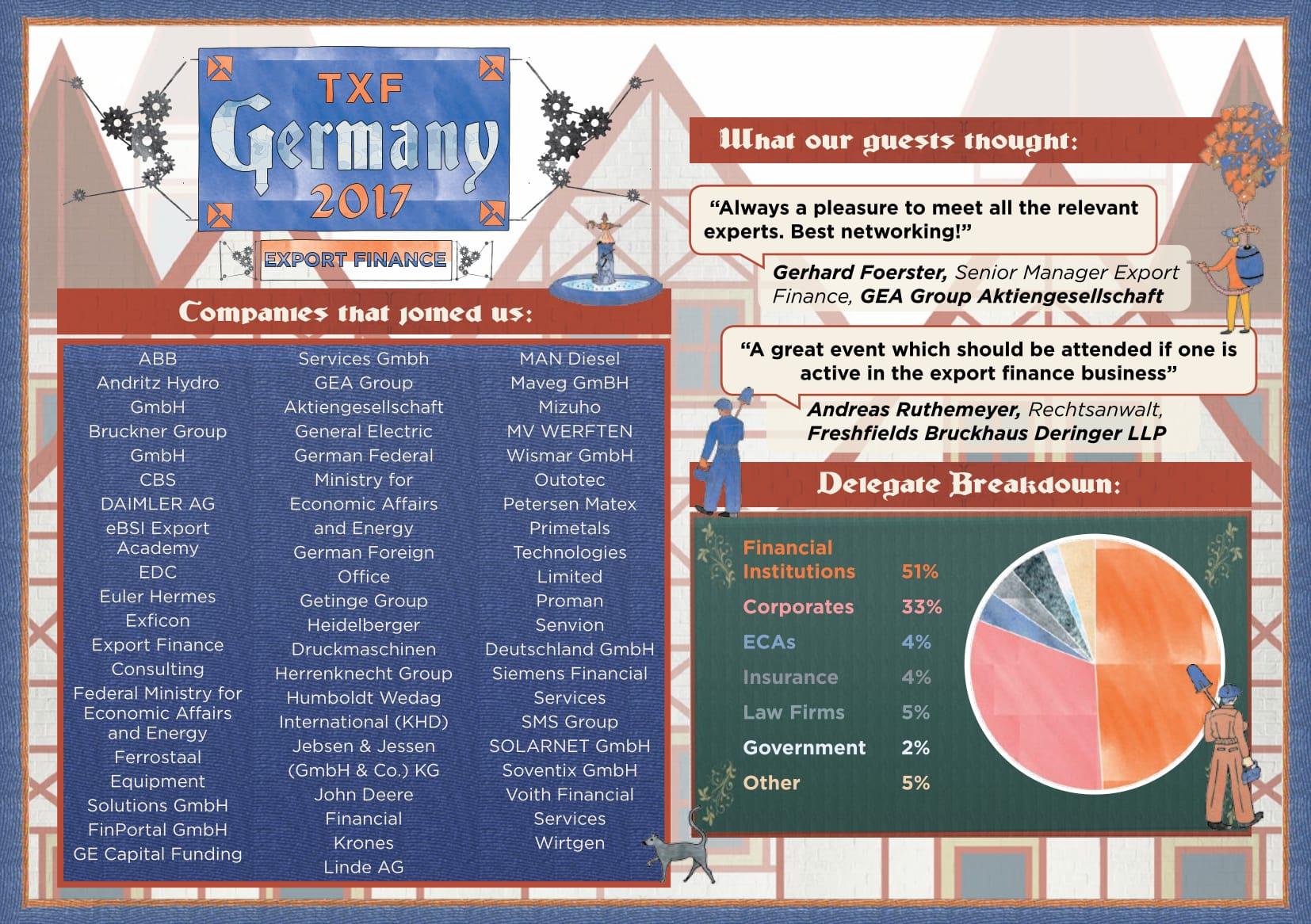

TXF Germany was a one-of a kind event. Capped at 120 delegates, conducted in German over two days and focused entirely on German export finance, it was a sell-out, focused conference.

If you are involved in this market then you were probably there!

#txfgermany

Key topics included: ·

GTB: Trade & Supply Chain Finance Afternoon

TXF also ran an exclusive workshop for practitioners and users of trade and supply chain finance. This session covered how better to bring financiers’ offerings in line with corporate treasury departments’ needs, through educative workshops and interactive roundtables.

Attendance was limited to 60 participants and was by invitation only.

Once again we held this exclusive gathering at AKA Bank HQ, situated in the centre of Frankfurt's financial district.

Thank you to everyone who joined us there. We hope to see you next year!