Chexim to fund Belgrade-Banja Luka motorway section

Autoputevi RS, the state-owned motorway operator of Bosnia and Herzegovina's Serb Republic, has signed a deal with the...

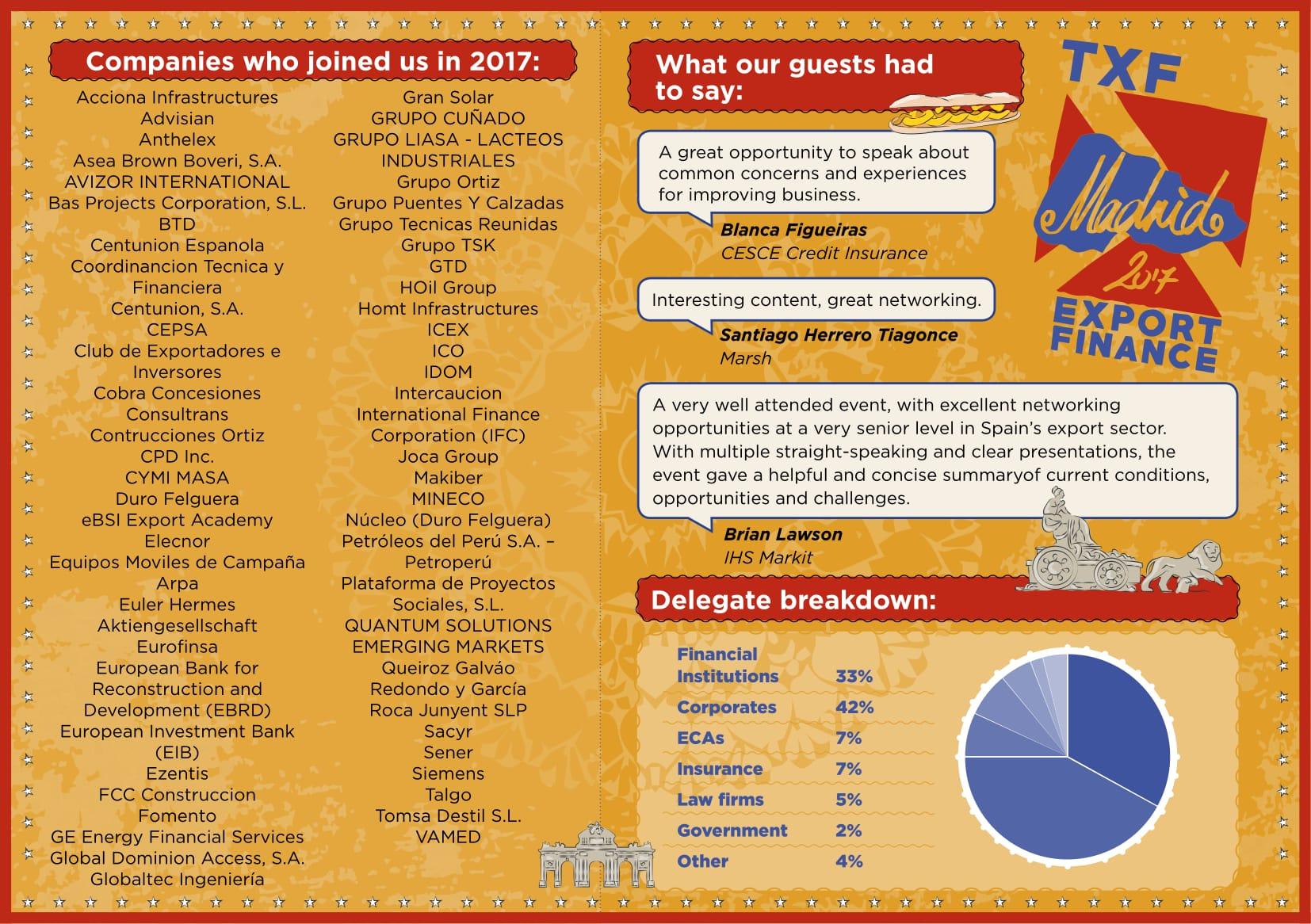

TXF Madrid is your event for the Spanish export finance market. It was a day of exciting discussion and debate with the best of the best from the industry all present in Madrid on the 7th September.

Attendance was capped at 120 guests and the event was conducted entirely in Spanish. This meant that our guest list only contained the most senior speakers and exporters. And that meant that our attendees were able to meet decision-makers who might be involved in a future deal.

Our guests also received expert insight into the opportunities available in Latin America, the Middle East and Africa, an update from CESCE from the new CEO, and the lowdown on the burgeoning infrastructure and renewables sectors. All from speakers who really knew their stuff.

We really hope that you enjoyed this year's discussion. We look forward to seeing you all again next year to get to the heart of the Spanish export finance market in 2018!

We will be returning to Garrigues' office in central Madrid for our export finance event.

Join us at Calle de Hermosilla, 3, 28001 Madrid, Spain on the 7th September.