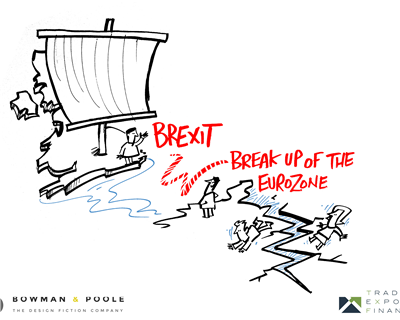

Trading more than insults: how would Brexit impact trade finance?

All the British EU referendum seems to have been good for so far is trading insults - as emotions run high in the last few days before the historic 23 June vote, and British politics reels from the murder of MP Jo Cox, it is worth taking the time for a more sober, analytical perspective on the Brexit debate.