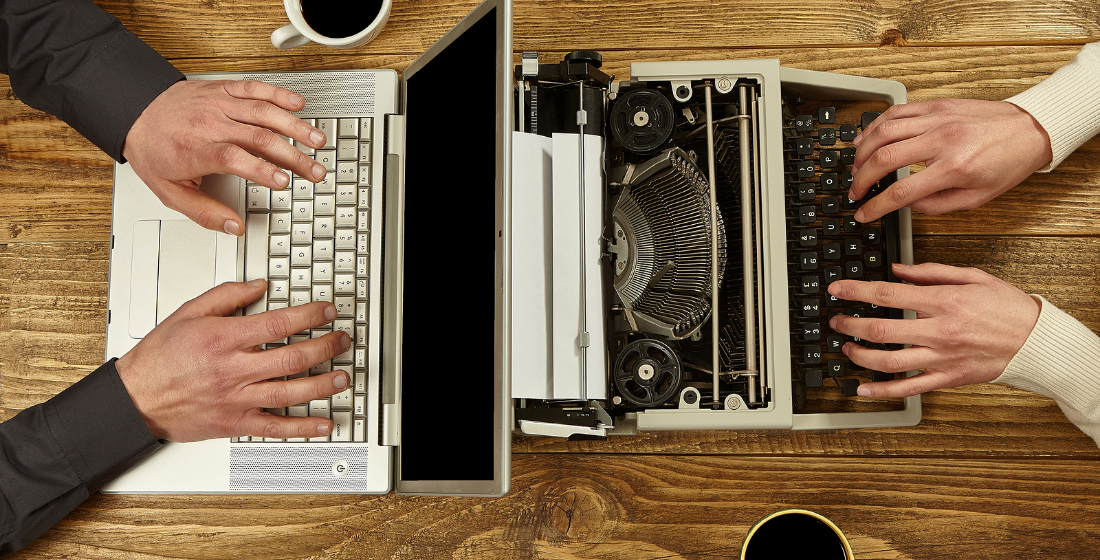

Old processes – new tools

Does technology hold the solution to more accessible financing and cheaper cost of debt for SMEs? Sunita Mehta, vice president of FI & Trade at Stern International Bank, and Sam Permutt, director at Stern International Bank, see a digital future for what is still a largely analogue trade finance industry.

Access to finance for frontier market SME exporters and importers has tightened considerably since international banks, hit by increasing compliance requirements and costs, started cutting back on their SME-focused trade finance offerings, opting instead to shed relationships (like RMAs) and focus efforts elsewhere.

One often unexplored reason why SMEs have not historically received enough funding is because the trade finance market is viewed as (and, empirically, is) analogue in an increasingly digitised world. However, FinTech’s recent embrace of trade finance may offer SMEs a financial lifeline.

While SMEs account for 75% of global trade, it’s well-known that the so-called trade finance gap amounts to $1.5 trillion per year, which is the gap between the capital SMEs require and the amount of financing provided. Such a gap is due, in large part, to the fact that the trade finance world has been, until recently, simply old-fashioned.

As opposed to other industries, there are no live prices available to view on Bloomberg terminals or Reuters screens when it comes to trade finance. Indeed, to know pricing, you have to pick up the phone, call up another person, and negotiate a price determined on a vague combination of costs of funds and demand. Moreover, standardisation and transparency are virtually non-existent; there is no system to track movements in pricing, no standardised rating system, and certainly no independent agency to handle the settlement of secondary market sales.

The vacuum is instead filled with staff – albeit knowledgeable and specialised staff – forced to manually sift through the various documents, goods, and country regulations (among other things) necessary to finalise a transaction. Compounding the problem further for SMEs is that traditional trade finance departments at institutional banks have continued to shed smaller customers and counter-party banks in developing countries as overall compliance costs continue to skyrocket.

The trade finance market is thus in obvious need of digitisation, and FinTech companies, along with the deep-pocketed VC-backers – seeing an opening – are starting to bridge the gap. LCLite, for example, directly connects importers and exporters via an integrated ecosystem consolidating transactions safely and efficiently across the supply chain and mirroring the benefits of a letter of credit at a fraction of the cost.

essDOCS is also stepping in to enable paperless trade. Its CargoDocs allows exporters, forwarders, and logistics firms to manage the online creation, exchange, and approval of trade documentation on one platform where all key original documents, including bills of lading, warehouse warrants, and certificates of origin are digitised and stored. And then there is HSBC, which during the Consortia 2019 event in London, discussed a new blockchain-based solution they are backing that seeks to remove the need for human intervention altogether when trading assets in the secondary market.

Such digital solutions will help trade finance assets become more accessible to a wider range of investors. Data will be more easily stored, verified, and shared. Credit information and trading history will be more transparent. Knowledge about pricing, and fluctuations in pricing, will be more available. And, importantly, the requirement for human specialisation will be cut down to a manageable size.

And, it’s already starting to happen – at least incrementally. For example, participants on the Tradeteq platform have already successfully conducted trades. The platform, which pairs up traditional trade finance banks with institutional investors, provides credit analysis where no public ratings exist, allows originators to pool their assets, and provides a vehicle for the assets to be securitised into easily transferable notes.

As other similar options materialise, the trade finance gap promises to close and under-financed SMEs should finally start reaping the benefits of new, bigger, bolder investment.