A path through the zigs and zags: TXF Commodity Finance Report 2019

This year's edition of TXF’s Commodity Finance Market Report comprises the insights of 173 traders, bankers, alternative financiers, lawyers, brokers, borrowers and insurers through a two-part survey and in-depth interviews. It is our most representative, expansive and detailed yet.

"Commodities tend to zig when the equity markets zag." That was Jim Rogers, the US investor and commentator. He's not wrong at the moment amid trade wars and global geopolitical instability. Uncertainty abounds. To make the path through the zigs and zags of financing commodities a little clearer, TXF has just released its annual Global Commodity Finance Industry Report. This is a deep dive analysis into the state of the industry and shows what the experts in the sector think.

This year's edition of TXF’s Commodity Finance Market Report has the insights of 173 traders, bankers, alternative financiers, lawyers, brokers, borrowers and insurers via a two-part survey with in-depth interviews.

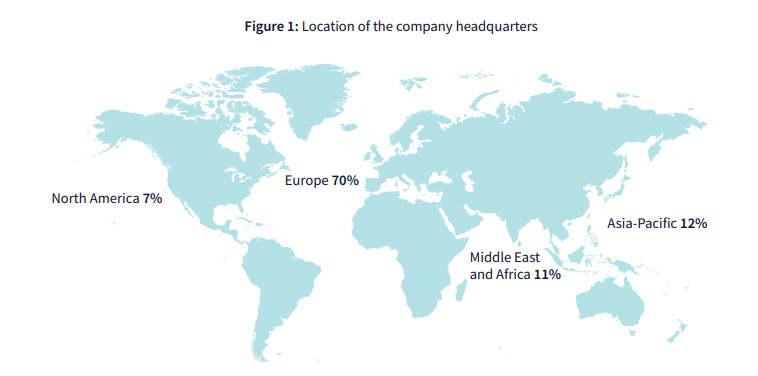

The majority of participants were traders and bankers (38% and 35% respectively), with alternative financiers, lawyers, brokers, borrowers and insurers representing the remainder. Over two-thirds of respondents’ companies were headquartered in Europe, with the rest split across Asia-Pacific (12%), the Middle East and Africa (11%) and North America (7%) (figure 1).

Respondents were in general agreement that all regions in the survey were ‘more’ rather than ‘less’ likely to experience change in business over the next 12 months, bar North America, which was predicted to be just as likely to enjoy the ‘same’ amount of business as is to experience ‘more’.

Naturally, most participants were focused on the energy sector (55%), followed by about one-quarter working mainly on agriculture/soft commodities and one-tenth on metals and mining.

Structured trade vs unsecured debt

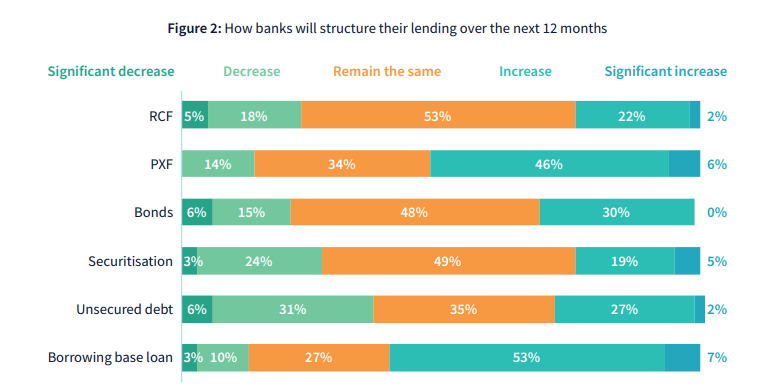

Overall, the market has favoured structured commodity trade finance - pre-export finance (PXFs), securitisation, borrowing base loans (BBLs) - in the past 12 months over taking the unstructured route - revolving credit facilities (RCFs), bonds and unsecured debt.

BBLs were the most popular type of borrowing/lending, with one-fifth of participants opting for this structure, closely tailed by PXFs (18%), RCFs (17%) and unsecured debt (16%), showing that unstructured lending still has a place in the commodity market.

Looking forward

BBLs are forecast to remain the most popular form of commodity finance lending/borrowing, with 53% having predicted an increase in volume and 46% having said the same about PXFs. Bonds and securitisation, which were the least favoured transactions this year, were selected as most likely to remain the same (figure 2).

Most respondents saw commodity prices on the rise over the next 12 months in the energy, agri/softs and metals and mining sectors at 60%, 57% and 65% respectively.

Sentiment was positive when asked if participants were expecting to expand their business to new markets, with around two-thirds (58%) intending to do so. Brazil was the preferred recipient country, followed by Egypt, Indonesia, China, Russia and Iraq respectively. Of these countries, the biggest challenge was considered to be legal/regulatory landscape.

Trade tech

The most used technology in commodity trade finance was electronic tracking of goods/cargo, closely trailed by electronic bills of lading.

Blockchain was predicted to be the most used technology over the next 12-24 months (17%)– excluding 33% who said they are not using any of the mentioned technologies and 50% who opted for ‘other’. Nearly two-thirds consider blockchain to be ‘somewhat important’ in the future, and a third cited it as ‘very important’.

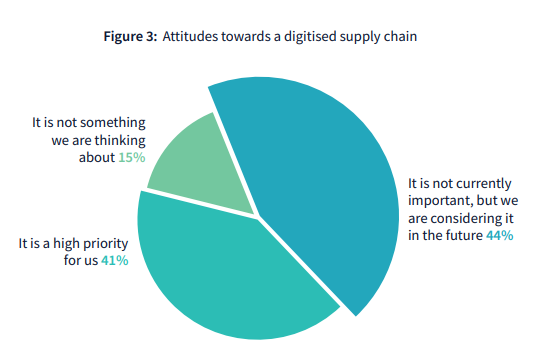

Participants were split in half when asked about their attitude towards the importance of a digitised supply chain, with 44% reporting that it is not currently important versus 41% who consider it to be a high priority (figure 3).

Sustainability

Unsurprisingly, almost every participant considered sustainability to be of importance the commodity finance world: nearly two-thirds (63%) selected it to be ‘very important’ and a third (34%) though it to be ‘somewhat important’.

Interestingly, there was a lack of precise understanding towards what defines sustainability, with a variety of answers ranging from ‘compliance and regulatory change are the driving force behind sustainability’ to ‘sustainability is a cultural and behavioural change concept’.

The greatest challenge to sustainable business is measuring the social and environmental impact that commodity finance-related business is having on the market.

For more information on this research or to discuss any research ideas you would like to see TXF undertake, please do not hesitate to contact tom.parkman@txfmedia.com. TXF Essentials subscribers can access a condensed version of the report by clicking this link, but please ensure you are logged into www.txfnews.com first.

Now time to get up to speed on the markets.

Here's our exclusive TXF Essentials subscriber content

Finding the sweet spot on trade digitisation and working capital management

Are corporate treasuries, fintechs and banks missing a trick on cross border working capital optimisation and what will the next five years hold? TXF's roundtable discussion of digitisation and international trade hosted in London by DBS highlights where the sweet spots will lie.

Saint Nazaire: A first financing for French offshore wind

France’s first offshore wind farm project financing – the 480MW Saint Nazaire scheme – had an extended deal gestation of over seven years after facing several legal and environmental challenges. But despite its troubled path to financial close, the deal priced at a margin and tenor on a par with more mature European offshore wind markets.

Rusal: Going green or a tinge of greenwash?

Given its status as the world's second largest aluminium producer, Rusal's sustainability-linked loan debut is good news for the growing ESG movement. But like other deals in the commodity sector that have closed before it, the financial structure in Rusal's deal lacks the teeth to leave no doubt that it is not tinged with a bit of greenwash.

How to get the most from CPRI: TXF talks to Boris Jaquet

Boris Jaquet, EMEA Head, distribution, Deutsche Bank talks to TXF’s Katharine Morton about his views of the state of play of the Credit and Political Risk Insurance (CPRI) market and how to get the best from CPRI ahead of the TXF Conference in London on 4 December 2019.

Plus, to top things off...

the news you thought you had but didn't

Trafigura to renew annual metals borrowing base

Trafigura will renew its annual $1.96 billion refined metals borrowing base by the end of this month.

Companies find opportunity amid global trade disruption

Businesses are more optimistic about their prospects to find opportunity in new markets than they were last year even as their expectations of protectionism continue to climb.

Amur GPP debt package nears signing

Bank allocations for Gazprom Pererabotka Blagoveshchensk’s €13 billion ($14.4 billion) Amur gas processing plant (GPP) project financing in Russia are said to have been finalised and the deal is expected to sign on 5 December.

IIF wind portfolio refinancing finalised

JP Morgan’s Infrastructure Investment Fund (IIF), with advisory from Santander, has pulled in eight banks for the €1.1 billion ($1.22 billion) 17-year loan to refinance its European onshore wind portfolio.

Nebras buys into Stockyard Hill wind

Qatar-based Nebras Power has bought a 49% stake in the 530MW Stockyard Hill wind farm from Goldwind in a deal that values the Australian asset at A$1.2 billion ($830 million).

Taiwan's CFXD wind project nears financial close

Financial close on Copenhagen Infrastructure Partners' (CIP) 600MW Changfang and Xidao (CFXD) offshore wind project is imminent according to those involved in the deal.

Condor reaches financial close

Mainstream Renewable Power has reached financial close on the $580 million debt backing its 571MW Condor project in Chile.

Beckers joins Apricum

German clean tech advisory firm Apricum has appointed Frank Beckers, former head of project finance and advisory at First Abu Dhabi Bank (FAB), as partner.

John Ahearn at Citi to change role

John Ahearn, global head of trade and treasury at Citi is to transition to the role of chairman of trade at the bank. He will continue to report to Naveed Sultan, global head of treasury & trade solutions group and remain on the Executive Committee of Trade and Treasury Services.

Maex Ament joins Greensill

Markus (Maex) Ament joins working capital and finance company Greensill as vice president of product and technology. Ament, co-founder of Taulia has, for the past two years been co-founder and CEO of Centrifuge, aiming to create a decentralised operating system for financial supply chain on the blockchain.

Berrington joins Local Partnerships

Michael Berrington has joined Local Partnerships (LP) in London as programme director for PPPs and PFI. He joins from Grant Thornton where he was principal consultant in the Energy and Environment team and Government and Infrastructure Advisory Services.

Bond closed to facilitate Carlsbad acquisition by Clearway

Carlsbad Energy Holdings – a subsidiary of Global Infrastructure Partners III (GIP) – has closed a $216 million 19-year 4.21% non-recourse bond backing its 527MW Carlsbad Energy Center project in Southern California.

Stefanek returns to Scotia

Konrad Stefanek has recently returned to the Power and Utilities Investment Banking team at Scotiabank, where he worked for over three years between 2013 and 2017.

More details on DSD's loan debut

More details have emerged on Distributed Solar Development’s (DSD) debut portfolio development loan closed on 22 October.

DEWA issues Hassyan RFP to shortlist of nine

DEWA has issued a request for proposals (RFP) to nine prequalified bidders for its 120 migd sea water reverse osmosis Hassyan IWP project.

Gallani joins Societe Generale in New York

Valtin Gallani has joined Societe Generale’s leverage finance team in New York as a director and senior originator.