19 reasons why Covid will accelerate digitisation in trade

Jacob Katsman, director at GlobalTrade Corporation, outlines the reasons why the Covid-19 crisis will speed up the digitisation of trade.

All of us have felt the impact of Covid-19 on our personal and business lives. When speaking about digitisation of trade it is evident that Covid-19 will help drive adoption of digital trade solution and electronic trade finance management platforms.

Jari Hanninen, GTC’s head of business development & client relations, Nordics says that many of his company’s clients realised during the pandemic how beneficial it is to have real time information about utilisation of credit facilities, up to date positions on outstanding transactions and being able to do the reporting from home at a touch of a button. "Our clients tell me that if they did not have access to an online Trade Finance management platform their company would have experienced delays in completing transactions and may even face losses," said Hanninen.

"Some clients said that it would not even be possible to handle their increased trade volumes with the same number of people, if they did not have a digital Trade Finance platform in place. When client’s own internal process is reflected in such platform internal decision making becomes transparent. Having all data in electronic form makes management, reporting, compliance, control, and audit activities much easier," added Hanninen.

Michael Vrontamitis head of trade, Europe and Americas at Standard Chartered and co-chair of ICC’s Trade Digitisation working group says, that if pre-Covid digitisation was a nice to have, now it is a must have. According to Vrontamitis, business continuity plans can no longer rely on people coming into the office to work with paper documents such as verifying the compliance of documents to a documentary credit especially as the concept of disaster recovery sites have been proven to be ineffective.

Harri Rantanen, business developer at SEB transaction services who also acts as one of driving members of the Standardised Trust community says there is a huge need on Trade Finance standardisation and harmonisation. Trade Finance will need a common language to make existing and new transformation enabling tools to interoperate on a better way. By this, end-customers and banks could more easily participate on any platform, system or processes making global trade easier and parties trusting each other as the Trade Finance tools could be more inclusive to mid-sized and small enterprises. With this enablement the Covid-19 disrupted current way of working at financing global trade can be faster transformed to a new, digitised set of practices. The ICC has announced the setup of the Digital Trade Standards Initiative in March 2020 underscoring the importance of standardisation.

With growing adoption of SWIFT MT 798 standards, connectivity between corporate and bank systems is becoming easier. Insurance companies that are largely not on SWIFT are using the web interfaces available in corporate trade platforms as a mechanism to connect and exchange information. While web interfaces are fine when processing a few transactions per day, they become unmanageable when transaction volumes increase.

The connectivity option that banks and insurance companies prefer is Application Programming Interface (API). An API is a software intermediary that allows two applications to talk to each other. Covid-19 has further fuelled the development of APIs by financial institutions, corporates and technology platform providers. The platform providers understood that without connectivity their solutions will fail to get traction. Those who predicted that blockchain will be the perfect answer to digitisation of trade realised that without the flow of transactions no matter how sexy the technology is there is no revenue and therefore no business. As the world reopens and accepts the new reality of living with Covid-19, digitisation of trade will continue to evolve.

Companies are increasingly open to accept technology solutions to problems that existed for hundreds of years. Hanninen, Vrontamitis and Rantanen agree that dematerialisation of paper in trade has started and will continue more rapidly during and post-Covid.

Here are 19 reasons why:

- People have realised that remote access to trade documents and transactional data is a must due to health reasons

- Business Continuity needs a Work from Home plan (WFH) not just Disaster Recovery (DR) sites

- Significant change will likely occur in the ways how we work in the future as working remotely has proven to work for most companies

- The ability to voice call and video call for free using mobile apps and WIFI made it possible to connect people irrespective of geography

- Covid forced institutions to accept electronic signatures and increasing standardisation is assumingly to be seen in this field

- Signing legal documents with lawyers via video conference tools like Zoom is now becoming standard practice

- Multibank Trade Finance platforms such as @GlobalTrade™ have proven their benefits during Covid to retain trade finance product data in one system in electronic form, having it accessible for all relevant persons in a remote manner, and recording all actions made with audit trail capabilities

- ICC is taking further steps to adopt legislation facilitating digital trade

- Electronic bill of lading platforms such as essDOCS and Bolero are gaining traction

- Financial institutions and corporates will increasingly continue developing APIs that would facilitate transaction flows

- Governments around the world are moving faster towards acceptance of electronic documents

- Logistics providers have invested and will continue to invest in capability of their systems to issue electronic documents

- Large corporates will speed up investment in integration of their ERP systems with multi-bank Trade Finance platforms considering also applicable APIs that would streamline process improvements and enable greater connectivity with financial institutions

- Common semantic models and taxonomies in finance, like UBL and FIBO, are giving tools for Trade Finance platform and system developers to make various electronic accesses interoperable

- Electronic corporate data sharing becomes a reality with new approaches using Distributed Identities and Verifiable Credentials making data exchange, even in finance, secure and fully digital

- Financial institutions and corporates are looking how to streamline their internal trade management processes with the help of AI and robotics

- Goods could be digitally tracked and followed using geofencing, instead of human monitored logistics steps

- Internet of Things and digitally secured data at the various parts of the supply chain will make more secure sustainability tracking and accounting easier compared to separately given auditing and notary services

- The trading parties have realised how vulnerable working with “original paper documents” actually is.

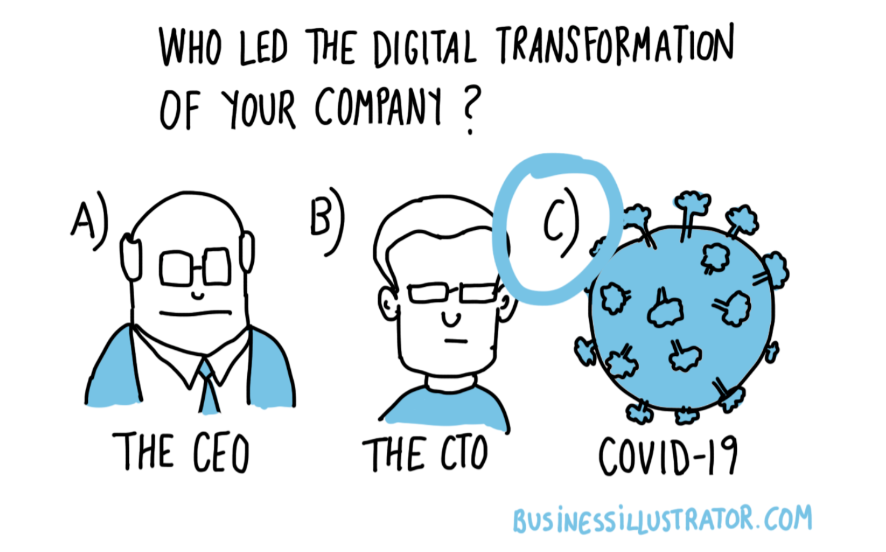

As the cartoon from businessillustrator.com illustrates it is not the CEO and not the CTO who is leading the digital transformation. However, senior management of companies now realise that they must have a digital strategy in place in order for their companies to survive. Trade has been in the paper world for over 100 years and industry experts would tell you that in many countries customs and other government agencies will continue to require paper documents to process import and export transactions. Having spent 20 years of my life digitising trade before Covid-19, having experienced slow adoption of technological change, I would say that trade services industry would likely stay with paper for the next 10 years. Today, living in the new normal during Covid-19 my view has changed. There are at least 19 reasons why adoption will now happen much faster. Those who said that fully electronic documentary credits and bank guarantees will not happen in their lifetime now would pause and say that they probably will.

Jacob Katsman is the co-founder and Director of GlobalTrade Corporation www.globaltradecorp.com and author of ‘How to Make Money Without Money The Art of Transferable Letters of Credits and Assignments of Proceeds’. He is also the Executive Editor of ‘Trade Services Update’ www.tradeservicesupdate.com, a legal financial journal covering practical aspects of payment instruments in international trade.