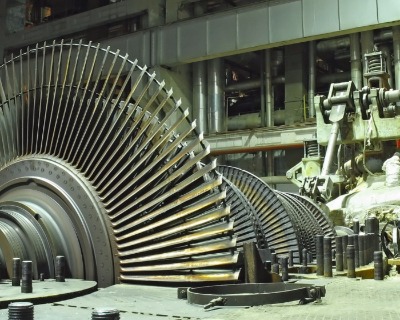

Perfect 10 Tengizchevroil: Big deal in a much bigger funding strategy - a TXF commodity finance Deal of the Year

The $3 billion Tengizchevroil pre-export revolver is ultimately a liquidity facility designed to enable optimum timing and pricing for future TCO bond issues. But the...