The complexities of CIRR revealed

TXF Research’s Global Export Finance Industry Report 2021 shows that 42% of the ECAs surveyed have unlimited access to CIRR and that 30% plan to increase their direct lending facilities in 2021. But with liquidity being allocated to fewer deals with bigger tickets, access to often attractive ECA support remains challenging for SMEs.

In recent times, commercial banks have tended to opt for an even more conservative stance, driven in large part, by the impending changes that Basel IV is placing on how the banks calculate risk. To further complicate matters for the banks, increasingly stringent regulation on ‘knowing your client (KYC)’ and anti-money laundering (AML), will mean that more time and resources are required in order to conduct complete checks.

These requirements will translate into an increased cost of debt which, as many predict, will be passed on to the borrower. It also likely means that banks will shy away from riskier regions and sectors that will require more capital to be held against their risk-weighted assets, and where KYC and AML will be even more challenging than a borrower in Europe.

This conservative stance appears to have translated into increasing usage of ECA financing as a way of capital efficiency and to help banks de-risk especially for lending in the emerging markets. However, TXF Data shows that in 2020, of the total $132 billion worth of deals that closed, nearly $68 billion was reserved for the top 14 borrowers. Given there were a total of 358 deals, this meant that 51.5% of the total deal volume was concentrated to just 3.9% of borrowers – a precarious position to be in. This concentration risk means that banks are chasing ever larger ECA deals with SME exporters struggling to get support.

A former global head of export finance still closely tied to the industry notes, “there is no evidence that the SME/MME world is receiving any better treatment by way of extra support. Liquidity appears to be reserved for less deals with bigger tickets.”

SMEs and MMEs often find access to commercial bank liquidity challenging, with the most active ECA banks preferring the higher returns associated with big-ticket large-scale project financings and MLT buyer’s credits. But given the super low commercial interest reference rate (CIRR) on offer from OECD ECAs, tapping ECA direct lending has never been more attractive.

ECA direct lending is not new. Its original goal was two fold: to provide the minimum interest rates applicable on OECD supported Export Credits. i.e. to make sure there is a level playing field so that all exporters and their ECAs do not undercut each other on finance; and to provide additional liquidity to an overseas buyer of an export, in order to support them to purchase goods and/or services especially from SMEs who also may have limited access to competitively priced ECA funding during periods of low commercial bank liquidity.

Direct Lending was particularly focused for buyers who tended to operate in higher risk profile regions and sectors, usually with a lower external credit rating, making them unattractive to commercial bank lending. It was also there to serve those SMEs who often deal with smaller contract values.

A recent report published by TXF Research specifically focusing on the ECA landscape found that 36% of the respondents had accessed an ECA direct loan over the past two years, primarily because they could either not access commercial bank lending at all, or could only do so at a very high price.

ECA direct lending is a misnomer; it is in essence funding at the CIRR. To uncover the complexities surrounding CIRR, TXF caught up with Gabriel Buck, managing director at GKB Ventures.

The intricacies of CIRR

To better understand how the CIRR is priced and why it is so attractive it is important to understand the construct as to how it is calculated. Firstly, CIRR is priced off the yield curve of AAA-rated sovereign bonds, not Libor (which is often much higher). Secondly, while priced off the yield curve, it is not on a matched basis. For example, the 8.5-year CIRR is based on a 5-year bond rate (plus 1%). Last, but by no means least, it is a fixed rate with no commitment fees during the drawdown period.

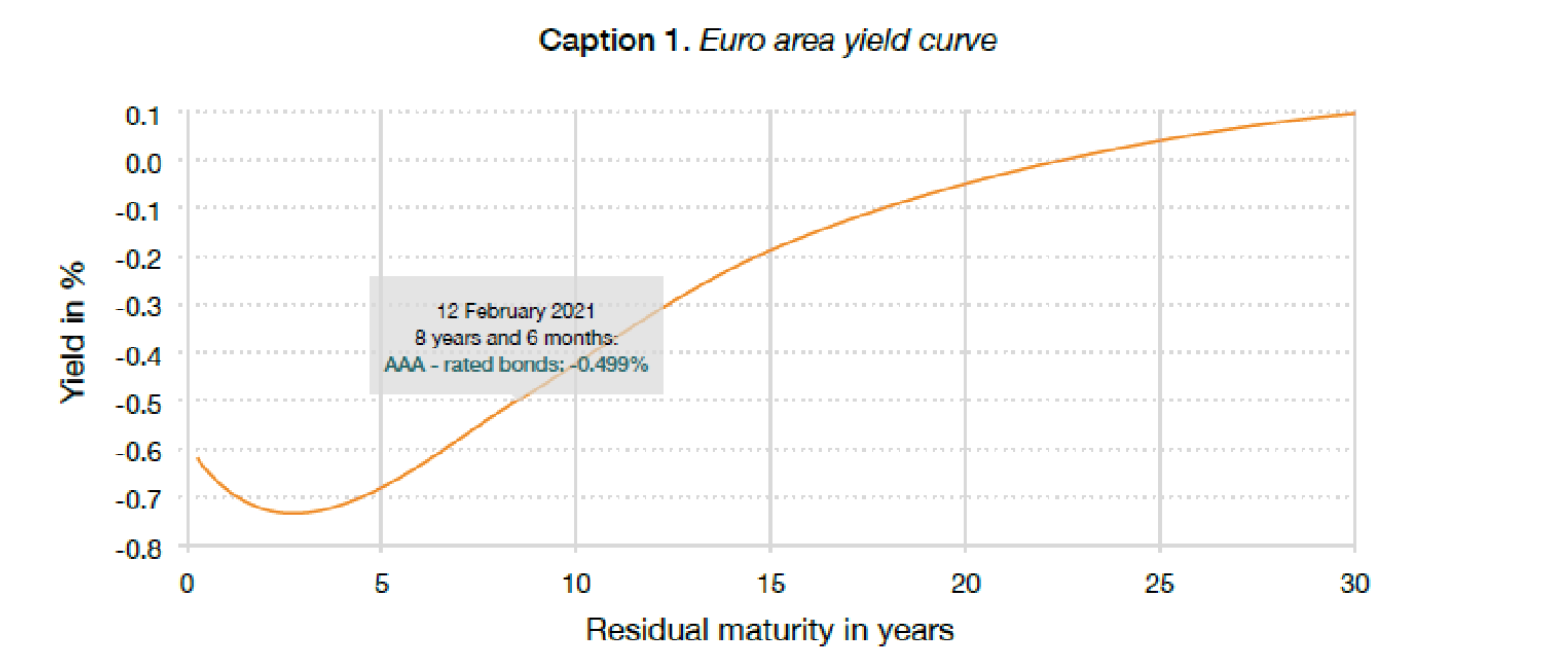

Caption 1 shows the yield curve for Euros as of the 12 February 2021. The yield curve is a forward rate curve which plots the yield of a AAA-rated sovereign bond against the residual maturity of a loan. Loan maturity can range from 3 months to 30 years.

The caption shows that for an 8.5 year term, the cost of a AAA-rated bond is minus 0.49%, or minus 49 basis points. However, the 8.5-year CIRR is priced off the 5-year Bond which has an even lower rate. Even when you add the 1% margin you can see why the CIRR rates are so low and so attractive.

Because of the construct it means that the ECA guardian angel (normally its MOF) is able to fund itself through the bond market (to institutional investors) at very low rates and then on lend via the ECA at the OECD CIRR. In doing so it makes an additional margin, or turn, as the “direct lender”. This “turn” is on top of what the ECA receives as a premium for taking on the credit risk.

In short, any ECA offering direct lending would stand to make a very healthy profit on top of the premium for the guarantee. This means that ECAs are able to generate revenue through two routes: interest made off of CIRR-based loans and premiums for providing the guarantee.

Turning to bank lending, Buck notes that banks just can’t compete with this level of pricing. He says: “With the yield curve shaped as it is and the sheer level of QE keeping these rates down it is very difficult for many banks to compete. Especially those banks whose funding costs are high. CIRR comes in cheaper and at a fixed rate with no commitment fee. Much cheaper than what many banks can offer. As a result, you can see why so many borrowers ask to tap the OECD CIRR and why many ECA use it as a competitive advantage to help their exporters win more business. It’s a win-win for ECAs that embrace the OECD CIRR route and for their exporters.”

Buck adds: “I give you a good example. Ed Harkins of GKB Ventures has been leading an advisory mandate with a West African Sovereign for an ECA deal for just under €300m. The facility was signed two week ago – the term was 13.5-year financing in Euro and the interest rate was….. wait for it…….. 0.32% fixed. Fixed for a 13.5-year term. Now clearly, this rate is ultra-low and has helped the African Government undertake this project – but what I find interesting is the comment made by the Borrower, to us, who looks at the OECD CIRR rate and knows that by definition it is the lowest rate allowed under the OECD rules. These rates are published and are public for all to see and, thus, by definition these rates are transparent. It is this transparency that many of our clients like about the CIRR rates.”

Further problems for export finance banks

It is important to state that CIRR is for OECD member ECAs and as part of the guidelines, OCED member ECAs are required to price fixed rates no lower than CIRR. However, non-OECD ECAs such as Sinosure or KEXIM, have the flexibility to use floating rates or to do untied financing – lending not tied to a specific export finance project. Or, as some often suggest, offer fixed rates below the OECD CIRR.

This creates several issues for export finance banks and OECD member ECAs. First, non-OECD member ECAs are still able to offer CIRR loans as well as any other floating rate they decide to choose. Second, it gives the non-OECD member ECAs an unfair competitive advantage over Member ECAs, as they have more flexibility to choose the most advantageous rate. Third, because the floating rates are not covered by the OECD Consensus, there is no visibility surrounding such credits. Finally, floating rate direct loans compete much more closely with commercial bank lending than CIRR-bases loans (Thompson, 2016). Consequently, not only do the banks already find it difficult to complete on price with OECD member ECA direct lending based on CIRR, but they also have to contend with non-OECD member ECAs that have even greater flexibility to use floating rates or untied lending.

TXF Research’s Global Export Finance Industry Report 2021 also found that nearly 50% of the ECAs surveyed have unlimited capacity to access CIRR, a situation, Buck notes, could make things difficult for some of the traditional export finance banks. Buck adds: “Banks are kept remunerated. Many Direct Lending programs need banks to be both the Arranger and Agent and some ECAs provide a small turn on the DL CIRR – which the ECA passes to the bank. It may not be as much as some of the traditional banks like to make but there are many banks who are keen on DL facilities. Especially local and regional ECA banks who are keen to do ECA financing but don’t usually have access because of their higher cost of funds. This way they compete and get a slice of the action through the DL programme.”

UKEF: One to watch

It’s DL programme is so successful it has started to run out of limits. Buck says: “We got the first inkling of this on 19 February when for the first time we were starting to see limitations on the allocation of CIRR even for Renewable Energy programmes. Clearly the pot allocated to UKEF from HMT is running dry. Hopefully this will be addressed in the forthcoming budget. We need to watch this and see how it develops.”

One of the unique features of UKEF is that not only does it have access to CIRR, but it can also protect itself via the national loan funding rate (NLFR) in the event that the yield curve moves away from them. The most recent annual report published by UKEF in 2020 stated:

To ensure that interest earned on each CIRR-based direct loan adequately covers the government’s borrowing costs, a check is made prior to commitment that confirms that the sterling CIRR applicable to the direct loan is higher than the corresponding National Loans Fund rate. If this is not the case, then interest on the direct loan will be charged at the higher rate. A similar arrangement, involving an interest rate check based on cross-currency swap methodologies, applies where direct loans are denominated in eligible foreign currencies.

This means that if at the time of the borrowing the British Government cannot raise the currency at the CIRR and that the costs of raising the funds are higher than the direct lending by UKEF is automatically increased to match the actual costs of borrowing. Buck notes: “This is quite clever. It means that if the shape of the yield curve changes or, for whatever reason, UK Government can’t raise funds at the AAA rate it will not be forced to lend out at CIRR when its own funding costs are higher. It is a “get out of jail card” in the event that the forward curve and the CIRR get out of sync. It means UKEF will not lose money on DL. Hopefully HMT will consider this when they look again to increase the DL limits for UKEF”.

The TXF perspective

Commercial bank lending is not about to be usurped by CIRR-based ECA direct lending - but ECA direct lending, whether tied or untied, remains an attractive export finance solution. The problem remains that some smaller exporters are not even aware of the product offering, while others find access to ECA support thwarted by complex loan application processes and lengthy due diligence procedures.

Furthermore, active ECA banks do not always offer borrowers CIRR, either - even when it is available. And on the other hand, not all borrowers want low fixed rate debt with many still opting for more expensive floating rates. This comes as no surprise given non-OECD ECAs continue to provide ample flexibility and untied direct lending in tandem with their speedy due diligence procedures, long tenors and lack of Consensus constraints. But the super low CIRR on offer cannot be overlooked, and exporters and borrowers of all sizes have an attractive instrument in their financial toolkits. Providing they know it’s there.

For more information on TXF Research’s Global Export Finance Industry Report 2021, or on any of its other focused publications, please contact Dr Tom Parkman (tom.parkman@txfmedia.com), TXF’s head of research.