Private capital investors in trade finance – an asset manager’s perspective

Private capital within trade finance activity comes from a diverse range of participants. Today, there is increasing involvement from private credit funds within trade and commodity trade finance, and given the widening global trade finance gap the opportunities continue to grow. By Amitji Odedra, director at Qbera Capital

For over 8,000 years the desire for goods from distant countries has driven the evolution of complex international trade networks in the form of global trade. Trade routes have left a lasting imprint upon cultures and markets across the world, many of which are still clearly visible. Despite this, its prominence as an asset class for today’s private capital markets remains nascent. This article seeks to explore the topic of trade finance from the perspective of an asset manager.

Trade finance as a subset of private credit

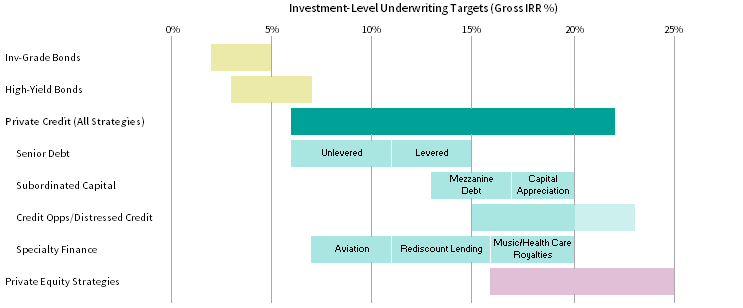

Strategies within the private credit sphere can generally be categorised as either ‘capital preservation’ or ‘return maximisation’ strategies. Capital preservation strategies, like traditional sponsor-focused mezzanine and senior debt funds, seek to deliver predictable returns whilst safeguarding against losses. Portfolios of this nature tend to be negatively skewed, with few losses and even fewer unexpected gains. Return-maximising strategies include distressed corporate credit funds and funds that focus on capital appreciation, offering the prospect of larger gains, they often have normally distributed to positively skewed portfolios.

Strategies that don’t easily fall into one of these categories are either opportunistic (investing across the credit spectrum as market opportunities permit) or niche/specialty finance strategies, like aviation finance or health care royalties.

Trade finance in its pure form would be categorised as a capital preservation strategy

Source: Cambridge Associates LLC

Note: Returns for investment-grade and high-yield bonds represent arithmetic return assumptions in equilibrium.

In summary, private credit strategies can be used to enhance or diversify traditional allocations such as fixed income or private equity. Simultaneously, private credit can be an excellent standalone allocation in a portfolio due to the range of risks and returns offered by its different strategies being broader than some other private asset classes.

What attracts private capital to trade finance?

One of the misconceptions of the market, particularly from corporates (borrowers) as well as other stakeholders, is around why trade finance funds/asset managers exist. Funds have generally been viewed as being ‘alternative’ lenders, those looking to address the trade finance gap etc. However, this has caused confusion in the market and a divergence in stakeholder expectation.

Whilst the trade finance gap and retrenchment/rationalisation of banks has aided the emergence of trade finance funds, one must consider funds from an investment strategy perspective within the private credit segment to uncover what is attracting private capital to trade finance and what characteristics trade finance has as an asset class. Only when one observes trade finance through such a lens will they understand why private funds exist and the role they can play in the ecosystem.

At a high level, some of the key characteristics driving the emergence of private credit funds (across the credit quality spectrum) to trade finance are:

Risk

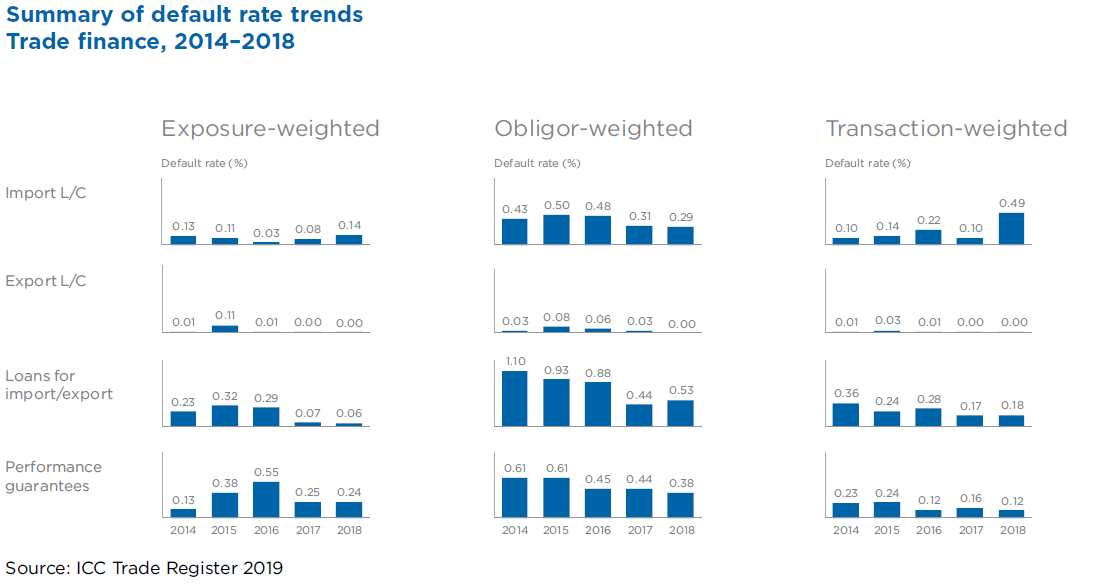

The International Chamber of Commerce (ICC) Trade Register 2019, highlights the low-risk nature of trade, with 2019 statistics showing:

- Exposure weighted default rate: loans for import/export 0.17%

Exposure weighted LGD: loans for import/export 37.7%

Exposure weighted expected loss: loans for import/export 0.07%

Whilst defaults and high-profile fraud cases grab the headlines, it is important to keep in context the overall macro situation as per the above data points and seek to understand the underlying reasons for potential and actual losses.

Intriguing Sharpe Ratio characteristics as noted by Eureka Hedge

Intriguing Sharpe Ratio characteristics as noted by Eureka Hedge

Duration

- Trade finance transactions are typically short term, under 180 days – when compared to other credit opportunities, these are few and far between (treasuries, short duration / short residual maturity commercial paper, corporate bonds etc.), and even more sparse in the private credit segment.

- To investors this represents greater liquidity (although trade finance is semi-liquid in nature) as well as ability to reprice more efficiently if credit conditions or base rate situations change

Diversification

Trade finance offers diversification opportunities on several fronts – not only from a private credit segment perspective, but also from a sector, geography, obligor perspective given that exposure on SMEs who do not have the ability to tap the traditional capital markets can be obtained

Low correlation

Trade finance has demonstrated limited to no correlation to traditional equity, fixed income or commodities markets, particularly when exposure was related to “defensive” sectors which as staple commodities, consumer staples etc. - Return

Depending on the nature of the trade finance fund, their source of capital and investment strategy blended with the above factors amongst others, it can offer a compelling investment case for private capital.

The characteristics of trade finance as an asset class is why private credit funds and investors exist.

Where is private capital focused within trade finance?

Considering the above rationale for the existence of trade finance funds, this gives us a wider perspective on where private capital and funds are focused within the vast trade finance market.

Broadly, there are four categories of private capital market participants:

- Private credit funds – Securitisation / Reg cap etc.

- Private credit funds – Risk participants

- Hedge funds / Direct lending funds

- Family offices

Private credit funds – Securitisation / Reg cap etc.

- These are more typical / traditional structured capital markets investors who participate in securitisation programmes as well as bank regulatory capital relief trades.

Private credit funds – Risk participants

- The type of investor can vary significantly, from family offices to institutional investors (pension firms, insurance groups etc.) who participate in transactions originated by specialist firms (banks, funds, platforms, or corporates directly).

- Generally, such firms are targeting assets in the investment grade quality segment.

Hedge funds / Direct lending funds

- These are specialist firms, such as Qbera Capital, who directly originate assets which are aligned to a specific investment strategy (e.g., a blend of sector, geography, product (e.g., receivables specific), and yield focus.

- Such funds are typically staffed by former bankers, who have vast experience in direct lending.

- Hedge funds / Direct lending funds raise their capital from a variety of investors – ultra-high net worth to institutional investors.

- Currently, most hedge funds / direct lending funds are focused on higher yielding assets as their ultimate investors hunt for yield.

Family offices

- Family offices also partake in direct lending (as well as investing into funds and risk participating). Whilst the world of family offices is somewhat opaque, there are several such offices which lend directly to corporates, albeit lending structures are typically a combination of trade / asset based and corporate lending with high yield expectations.

Depending on the investment objective of an investor, they can partake in gaining exposure to trade finance directly or indirectly, as well as across the credit and risk-reward spectrum.

Complimentary vs. alternative finance

As we touched upon earlier, private credit funds in trade finance have often been called ‘alternative lenders. This has resulted in some confusion and misalignment of expectations in the market. Whilst trade finance investing might be classed as an ‘alternative investment’, it is very much a complimentary solution to more traditional lenders such as commercial banks, particularly when it comes to private credit funds who are involved in direct lending.

Specifically, regarding direct lending funds, many have pursued investment strategies where the blend of investment criterion retained a focus on the higher yielding segment of trade finance. This can come as quite a shock to corporates who have been used to bank pricing and perhaps did not expect such from these ‘alternative financiers.

However, with the increasing number and variety of private credit participants in trade finance, the market has evolved in recent years, with certain investment strategies competing with the banking and factoring market. From a borrower’s perspective, trade finance funds can be a useful provider of liquidity, having the ability to be more creative than banks when it comes to structuring facilities, the speed, risk appetite etc. which has been noted in this survey’s findings.

Additionally, to emphasise the point made above, along with the complimentary nature of direct lending funds, we have seen examples in the market where banks and private funds have successfully partnered together, with the fund taking the riskier portion in a trade which is aligned to its investment strategy and a bank focusing on a segment of a trade flow which is aligned to its appetite.

A public example of this is Czarnikow’s collaboration with Kimura Capital where Tanya Epshteyn, head of structured finance at Czarnikow, said: “There is no need for one form of finance to replace another. There is a pronounced need and space in the market for the risk takers and the capital providers to work together in a safe, collaborative way that includes all facets of the supply chain and fully supports the real economy, rather than singling out the elements which match the high yield curve or fit the traditional collateral valuation boxes.”

In the conventional and high-yield loan market we have seen how commercial banks and private credit funds can provide solutions that the market requires by working competitively and collaboratively. Trade finance funds should be seen no differently, there is no reason as to why commercial banks and trade finance funds cannot co-exist. The market is a better place with both.

The importance of ESG to private credit funds

From an asset manager’s perspective, the ESG pressures are significant, and rightly so. Investors who provide capital to asset managers are constantly seeking to allocate to funds following a rigorous ESG approach as part of their investment process and activities. ESG fund inflows have been some of the greatest and fastest since 2019.

Morningstar data shows that global sustainable funds attracted a record inflow of $185.3 billion in the opening three months of the year, a 17% bump in new cash being invested, compared with the prior quarter hence asset managers are very well incentivised to be at the forefront of ESG integration. Interestingly however, in a new survey conducted by TXF, it showed that: “nearly 60% of the corporate respondents noted that alternative asset managers do not meet their ESG requirements” – as an asset manager, this is a surprising finding, particularly given the point above.

Perhaps the reason for this finding is that ESG has become one of the most used global acronyms in the past 24 months, encompassing a very important set of topics which do not yet have a market standard. Everyone is taking about ESG, but who truly understands it, how to integrate it, how to monitor it, how to do more than just data collect? It is possible that only those who have been practicing as specialists for many years vs. the increasing number of people (asset managers, banks, and corporates) taking short courses and e-learnings and becoming experts overnight.

These matters become increasing complex when it comes to integrating factors for trade finance transactions – where does the focus lie and where is a line drawn? At a corporate level, at a trade flow level, how detailed do you assess the buyer and supplier? Do you also evaluate the shipping / transport company, the fuel used?

A rather cynical view, but it looks like the rush to be seen as market leading, ethical, sustainable etc. leaves marketing and communications teams in overdrive. Activities which are not properly understood or being adequately managed when it comes to ESG matters by commercial, investment and risk teams are at risk of being overstated.

As an asset manager, one cannot not consider ESG, or not be constantly seeking to improve one’s understanding and integration of ESG across its activities. As the market develops and knowledge across stakeholders, the different interpretations and accordingly expectations of ESG should align.

Increasing private credit fund participation in the trade finance market

Increasingly, trade finance has been attracting private capital across the credit spectrum and a range of participation formats. However, there are several factors which have hampered its development as a mainstream subset of private credit.

Putting aside credit and fraud events (which are also present in equities, fixed income, term debt, and other asset classes), the major challenge for trade to attract private capital at a large scale has been around standardisation and investor understanding of the risks involved in an activity that is still heavily reliant on paper documents and human skill and experience.

In a bid to tackle this, there have been many great initiatives from the creation of e-documentation, blockchain based solution, platforms etc. However, for the time being it seems that the optimal approach for private capital to access the asset class is to work with specialist firms – banks and trade finance funds who can originate, structure, and monitor and manage trade finance risk. Although investors need to emphasise their due diligence on both the originators as well as the underlying asset class.

To attract further capital in an efficient manner, all stakeholders in the market need to work together towards greater standardisation and increase efforts which help to educate private capital, only then will trade finance cross the hurdle which the term loan markets did in the 1970s and 1980s.

Qbera Capital, headquartered in London, is an independent advisory and asset management firm, facilitating and providing debt and equity solutions for real economy assets and companies specialising in the energy (including renewables), metals, agricultural sectors. For more details: https://www.qberacapital.com/