Metallurgical and thermal coal: Different cokes for different folks?

Provisional results from TXF's annual Export Finance Industry Survey indicate that the retreat by export finance banks and ECAs from coal is very real. But it is also largely indiscriminate in its application to thermal and metallurgical coal, a commodity that is still required by the steel industry and will continue to be until the fledgling green steel sector can be scaled up. Is a more considered retreat required?

Over two-thirds of banks currently invested in coal plan to abandon coal entirely, according to the provisional results of this year's TXF Export Finance survey. The move would all but eliminate remaining bank support for coal within the export finance industry.

The survey also found that just 18% of banks are considering metallurgical coal (used in the production of steel), with the remainder of banks (12%) planning to partially pull back, a clear sign that a majority of banks active within export finance are in the process of hastily amending their portfolios to exclude coal entirely.

The picture is much the same on the ECA front – 76% of ECA’s disclosed that they either do not support coal or have policies in place that restrict and phase-out support for coal. Just one ECA reported not having any policies in place to phase out coal. Much like the banks, ECAs also reported little interest in metallurgical coal, with merely 9% of ECAs reporting that it is something they may be willing to support.

The survey will remain open for one more week – and if you'd like to participate please click here. But even though these results are not final, with a record 29 banks, 18 ECAs and hundreds of exporters and importers taking part, the initial results are a reliable indicator of sentiment and activity across the export finance industry.

The view from TXF data

A more complete picture of coal trends within the export finance market can be constructed via scrutiny of TXF Data.

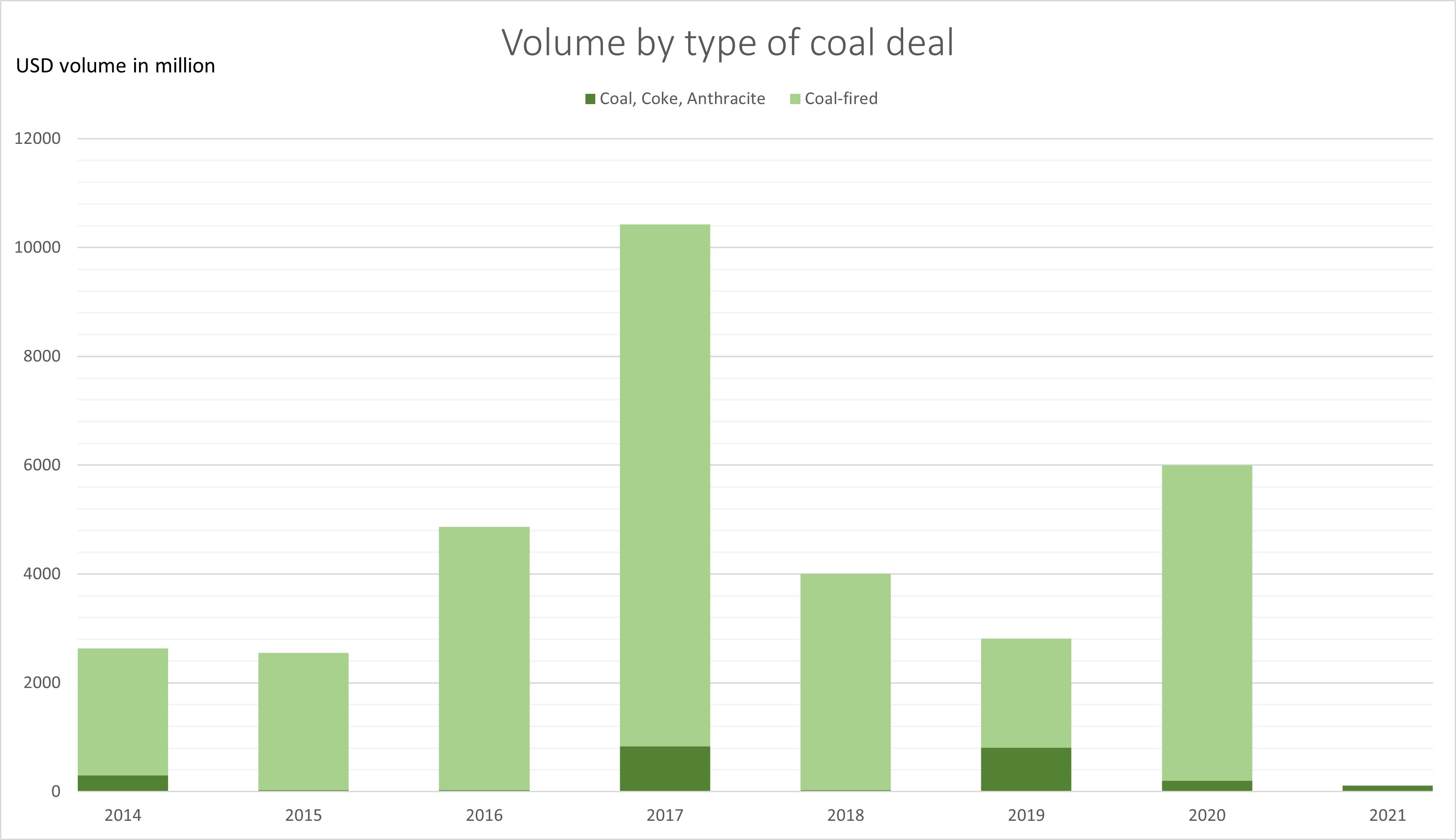

While export finance deals in the coal sector (coal-fired power and mined coal) have historically been a small part of the industry as a whole, 2021 was particularly notable for its conspicuous absence of coal deals. Throughout 2021 TXF Data shows that only two ECA-backed coal deals closed, with a combined total of $109 million (both JBIC direct loans), representing just 0.09% of the total volume ($117.9 billion) of all export finance deals TXF recorded in 2021.

By comparison, five deals closed in 2020 with a combined volume of just under $6 billion, 4.5% of the yearly total volume ($133 billion), although this was actually an increase on 2019 and 2018 volumes.In fact, not only were volumes considerably lower than previous years, 2021 saw the lowest combined volume for coal deals ever recorded by TXF data in a single year, suggesting the survey findings that the export finance industry is well on its way to abandoning coal for good has credence.

Source: TXF Data

Analysing the data in finer detail, the huge drop in volume in 2021 looks to be attributed to the lack of coal-fired deals in 2021. TXF Data shows that since 2014 there have been an average of three to four coal-fired deals a year, the majority with individual volumes between $1-3 billion. The three coal-fired deals that closed in 2020 for example had a combined volume of $5.8 billion, whereas the combined volumes for the two mined coal deals was $206 million in the same year.

While we can see a general dip in export finance deal numbers across the board in 2021, the exodus away from coal, in particular coal-fired deals, is striking, likely signalling an end to support for coal-fired power amongst the ECAs and banks.

The case for coking coal

The abandonment of thermal coal by most banks and ECAs should come as no surprise post COP 26 and the collective agreement to “phase down” coal power, not to mention the recommendations in the 2021 ICC White Paper on sustainability in export finance. However, such a dramatic purge of all coal (thermal and metallurgical) may be a case of ‘baby out with the bathwater’. At precisely the time banks are reorienting their portfolios away from coal, the demand for metallurgical coal has risen as global economic activity rebounds and lockdown restrictions continue to ease. China's major infrastructure investments and Joe Biden’s Bipartisan Infrastructure Bill in the US are two major developments that have pushed up the price of steel, along with its essential ingredient, coking coal.

Furthermore, as a key material in production of electric vehicles and wind turbines (71-79% of total wind turbine mass is steel) steel is also central to decarbonisation efforts. The result of the sustained increase in demand, coupled with the current unviability of ‘green steel’, has led the IEA to predict that metallurgical coal consumption will increase an average 1.7% per year up to 2024.

Down but not out

If banks are committed to pulling support for metallurgical coal, SMEs and MMEs involved in coking coal extraction may find it almost impossible to access traditional commercial bank liquidity. JBIC’s two $50 million direct loans in 2021 to trading houses involved in the development of coking coal mines in the US and Australia is a neat illustration of this. These deals are also a reminder that Japan remains entirely reliant on all coal imports – a state of affairs likely to remain for the foreseeable future.

The survey results, cross-referenced with TXF Data, suggests that in the context of unabated demand for all kinds of coal it might be premature to proclaim the death of coal, at least metallurgical coal, in export finance. This is not to say the dearth of coal deals in 2021 looks set to dramatically reverse – neither the survey results or TXF Data point to anything other than the culling of coal support in 2022.

TXF Data's Export Finance Industry research report, covering all the export finance trends for 2022, will be out in full on April 1st. As stated earlier, there is still time to participate in the report and your input would be very welcome – please click here to access the questionnaire.