DFIs and brokers: Insights from BPL Global and Frontclear on enhancing local money markets

To address these challenges, insurers and DFIs have been working together to extend the reach of development financing into local capital markets. In a recent briefing, Uxolo and TXF sat down with Charlotte Hampshire, director at BPL Global – a credit and political risk insurance broker – and Hugh Friel, the vice president of Frontclear – a financial markets development company – who are among the leading players in this space.

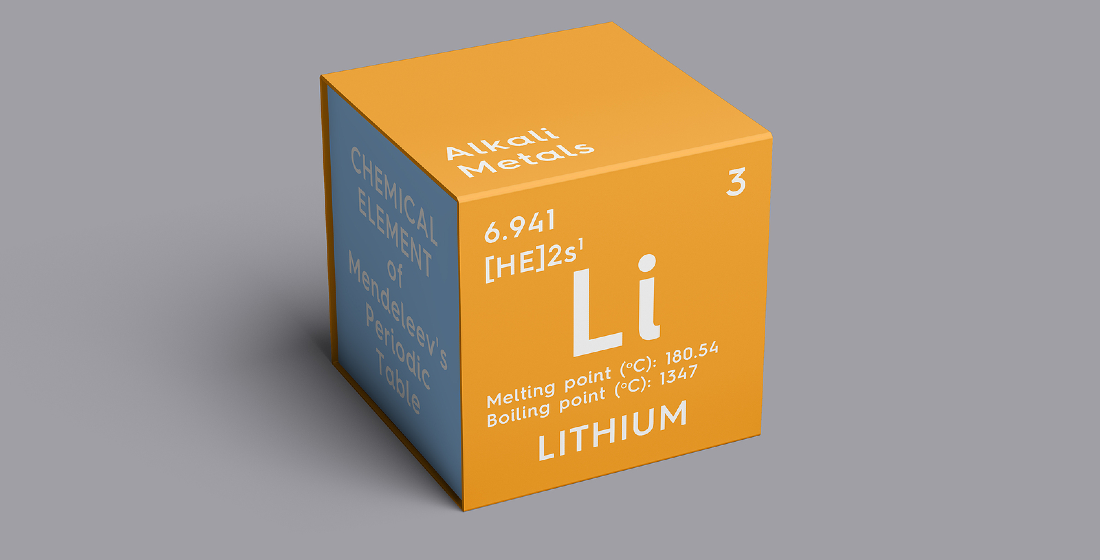

(01:18) Frontclear is focused on developing money market instruments and improving the efficiency between banks in emerging markets. (01:50) Their primary tools are guarantee instruments that absorb counterparty credit risk, and technical assistance work aimed at developing institutional capacity for interbank transactions.

(03:36) Credit and political risk experts at BPL Global provide insurance to clients such as Frontclear, which allows them to free up their limit to enter into further trade in emerging economies. (05:02) Hampshire also discussed how BPL Global raises awareness in the private insurance market about the structural merits of Frontclear’s work.

(06:48) Delving into the crucialness of money markets, Friel describes how the government debt market currently dominates the interbank sectors. (07:27) Money markets allow financial sector actors to clear their liquidity, create a reference rate from which products are priced off, and ultimately contribute to economic development.

(09:06) Then Friel describes a case study, a guaranteed transaction in Ghana from 2018, which BPL Global shared in and allowed Frontclear to take extra capacity on. Like in this case, Frontclear’s typical transactions involve taking on government bonds as collateral and introducing risk mitigating features like haircuts and marginal terms in secured interbank transactions.

(21:38) Touching on the criticisms that private insurance has not been doing enough in emerging markets, Hampshire raises the importance of partnerships in providing comfort to the private sector. Placement consideration is driven by an understanding of where and how transactions will be underwritten and insured, and about the due diligence, expertise, and reputation partners can provide, like DFIs and MDBs. (25:46) Friel highlights that though Frontclear’s products are niche, BPL Global has been successful in placing over 90% of the transactions brought to them.

(26:52) And lastly, the conversation reflected on current risk profiles in emerging markets. Providing insurance is partly reliant on strong recovery rates, according to Hampshire, and BPL Global’s data shows Africa’s recovery rates close to 40%. With each unique case of debt restructuring, she outlines that there will be a unique market response. (28:36) Friel adds that, from a risk perspective, debt restructuring programmes are complex and require a deep understanding of the legal, operational and technical aspects involved – which is testified to by how long they take.