CPRI claims – are the dogs barking, or merely growling?

A new survey reveals the latest claims data for the CPRI industry. What do the figures tell us about the CPRI market? Is the claims market normalising, whatever that may mean, and what does the future hold for potential claims if insolvency forecasts are anything to go by? TXF investigates the latest market survey data.

May is a good month to look at whether the proverbial dogs that didn’t bark have started to growl yet – those un-barking dogs refer to claims in the credit and political risk insurance (CPRI) market. Claims are, of course, a lagging indicator, but since the pandemic, the figures are interesting. What are the numbers telling us? For sure, future insolvencies aren’t necessarily future claims, they can be restructurings and reschedulings. But are the CPRI claims we’ve been talking about since the pandemic began actually happening, and, importantly, are they being paid? And what comes next?

We will be discussing these trends in more depth at TXF Global 2023: Export, Agency & Project Finance event in Lisbon in the CPRI Club stream on 15-16 June, and going into greater depth in the session ‘Claims 101: What can we learn from the figures?’

Are the CPRI claims we’ve been expecting since the start of the pandemic coming in now? John Lorié, chief economist at Atradius Credit Insurance, says yes, “to some extent in 2022, but much more in 2023, after which the rise will slow down”. After two years of declines during the pandemic years, global insolvencies rose by 9% in 2022, Lorié notes, pointing to the end of COVID fiscal support and the lifting of temporary changes to insolvency laws. In some markets, it’s back to normal for insolvencies, or even higher than pre-pandemic levels.

“Indeed, for 2023 we see an increase of 49% in the global level of insolvencies, as ‘return to normal’ continues. In 2023 we are seeing rising insolvencies across all regions, with North America experiencing a relatively strong increase, while Europe is seeing milder increases. The majority of countries in each region can expect rising insolvencies this year. In 2024, the picture is more mixed. On a global level, we predict that insolvencies will rise by 12% compared to 2023. In most markets that we observe, insolvencies are expected to have more or less normalised in 2024.”

But how is that picture relating to actual claims data? “The market has just released 2022 claims figures for regulated financial institutions which shows another strong CPRI industry performance with just shy of $530 million paid in full and on time,” Claire Simpson, managing director, head of claims solutions at WTW (Willis Towers Watson), tells TXF. “Counterintuitively, given the current political and economic landscape, this shows a year on year reduction in claims collected of 48%, a trend echoed in WTW data.”

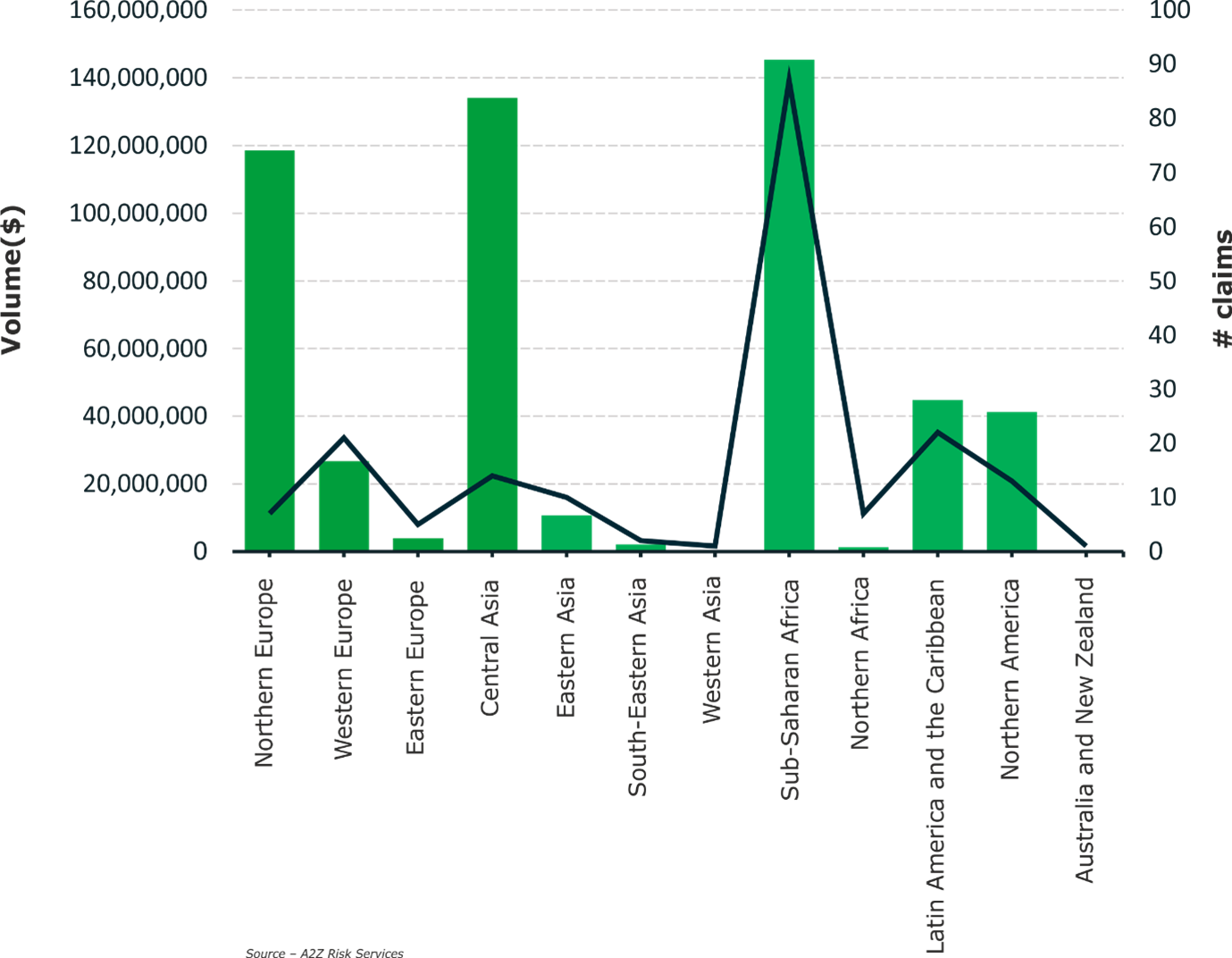

In the market survey of data compiled by A2Z Risk Services, $529,534,436 was paid out against (a total of 190) claims under policies covering comprehensive non-payment for regulated financial institutions where the insurer was contractually required to accept liability in 2022. “We are pleased to announce that, according to data submitted by the participants (1) in this year’s survey, 100% of the claims made by regulated financial institutions in 2022 were honoured as required by the insurance contract,” notes Audrey Zuck, director at A2Z Risk Services.

The industry mantra ‘trade gets paid’ seems to be bearing out according to the survey numbers. The overwhelming majority of claims, 95%, whether by frequency or amount, were for trade-related transactions.

The split between public and private sector was pretty even, but private sector claims made up more than 71% in terms of the value of claims paid. “Although the frequency of claims was roughly the same for public sector and private sector obligors, the amount of claims for private sector obligors was over twice the amount paid in respect of public sector obligor default,” Zuck notes.

Sub Saharan Africa claims prominent

Strikingly, according to the survey, nearly half of all claims paid in 2022 were in relation to Sub Saharan Africa (more than $145 million). Some 87 of the 190 claims were for risks in Sub Saharan Africa, with claims in Africa marking nearly half of all claims in volume, 28% in value terms.

This chimes with WTW data. For example, ongoing Zambia contract frustration (CF) settlements accounted for 50% of claims paid in 2022, according to WTW’s 2022 claims review. Simpson also expects an uptick in claims coming through this year already. “The first quarter of 2023 has however seen the start of claims materialising from the December 2022 Ghana default which we anticipate being a more significant insured loss event than Zambia,” she says.

“Credit losses outside of the sovereign space are lighter than usual so we are not seeing the anticipated post pandemic pick up in claims activity which is interesting and may be more reflective of some demand shifts we are seeing in our portfolio,” explains Simpson.

And those shifts in demand are interesting too. “As at today WTW’s top country exposures are the US and UK. Not that long ago we would have expected China and Brazil to feature heavily but these days those countries do not even feature in our top 10 countries. That improvement in country risk profile and also the increase in exposure to investment grade credits is perhaps one explanation for the reduction in losses and the continuing growth in market capacity but we must remain vigilant to any financial shock to challenged economies such as Turkey, which could lead to a very different loss trajectory," Simpson says.

Geopolitics, war, geography, climate

With rising debt levels, particularly in emerging markets and in Africa, where will the figures go from here? On a regional level, Atradius foresees a relatively strong increase of insolvencies in North America (71%), which is mainly driven by the US. For Europe, Lorié expects a “relatively mild” increase of 27% as “the process of normalisation of insolvencies in Europe is already more advanced compared to other regions. For Asia Pacific we predict an increase of 56%.”

For the emerging economies Atradius tracks, such as Turkey, Russia, South Africa, Romania and Brazil, the overall picture is one of muted insolvencies growth. “The picture is very heterogeneous here, also reflecting different levels of pandemic government support. In Turkey for example, currently facing various economic challenges and limited pandemic, the number of insolvencies has grown over the pandemic period to a level almost twice the one pre-pandemic. With some economic stabilisation on the horizon, insolvencies are forecasted to show limited growth. In Brazil on the other hand, the number of insolvencies has so far remained far below pre-pandemic numbers and is forecast to grow only on a limited scale.”

“The major drivers of Atradius’ forecast are the normalisation process after the pandemic, including zombies’ defaults, as well as the general economic situation as captured by GDP. The latter indeed reflects the impact of geopolitical uncertainty, the Ukraine war and climate change,” Lorié says.

“Indeed, since the Ukraine war we have seen a surge in an already existing upward inflation trend coming from energy prices. This has accelerated the monetary tightening process already underway, with especially the Fed increasing the pace [of tightening]. This has resulted in higher borrowing costs for firms and recession fears for a global economy that had not fully recovered from the pandemic shock. Another example is the earthquakes that have hit Turkey in February, constraining Turkish GDP already under stress due to high inflation and lira depreciation. Climate change appears, for example, in the form of droughts, heatwaves, flooding and strong winds or even tornadoes. Vulnerable economies such as Pakistan have limited means to cope with this, putting a drag on economic growth.”

Are the corporate ‘zombies’ at bay?

Are there any signs of that dreaded ‘zombie’ scenario the market had been concerned about? Atradius based its forecasts for 2022 on the idea that countries will see their insolvency levels return to ‘normal’ levels with pandemic-related fiscal support being discontinued, and assumes that it can take up to eight quarters after government support is discontinued before the insolvency level reaches the level of normality.

“On top of the normalisation, we distribute on the forecasting horizon additional defaults coming from zombie companies,” Lorié says. “The latter are likely to occur because in the pandemic period the insolvency levels contracted well below their pre-pandemic levels. We believe that these companies will default after the government support is withdrawn. The dominant driver on insolvencies’ development after government support has ended is normalisation of the number of insolvencies in a country.”

He notes that some of the firms that should have gone bankrupt during the pandemic will play a role as well. “We are seeing that currently for example in the UK and Switzerland. But this number falls short of the number of bankruptcies that may have occurred in the absence of government support. In that sense, we do not see a feared 'wall' of zombies’ bankruptcies.”

Demand shifting on the buy side

“The last couple of years have been benign in the US, but that trend is changing and we’ve seen an uptick in bankruptcies and larger claims as the government tries to slow the economy and interest rates are rising”, adds Harpreet Mann, president, Amynta Trade Credit & Political Risk Solutions [a managing general agent (MGA) which operates on behalf of SCOR]. More bankruptcies could see further rescheduling if interest rates continue higher, and costs of insurance are sometimes harder to justify by corporates faced by increasing premiums on other lines of insurance which may affect renewals.

Nonetheless, banks are increasingly looking to CPRI insurance in syndications. “We’re seeing more inquiries from banks than in previous years. Some banks are using [CPRI] for capital relief where they can, and US banks are exploring that increasingly. There's some work being done also in the industry around reaching out to the US Fed to get clarity on what the risk weighting treatment should be for credit insurance policies so that there's meaningful capital relief. The claims experience, as the A2Z industry survey shows, has been good for the banks through COVID, and that’s definitely bolstered some banks’ use of CPRI in the US market,” says Mann. She sees the US as a growth market for CPRI as, to date, it has not been heavily penetrated, and it could be a good distribution tool for banks.

Meanwhile, there has also been advocacy in the UK and Europe on the UK Prudential Regulatory Authority (PRA) at the end of March to lobby for more appropriate treatment of CPRI and trade in relation to the implementation Basel 3.1 standards. Certainly, Basel treatment of CPRI in trade for bank capital adequacy purposes remains a big concern.

Become a subscriber today for unrestricted access to the best export, trade and commodity finance analysis available.

Click here for information on the different packages available for you and your team

Exclusive subscriber-only content published last week:

AIIB, IFC propose $230m refinancing of crossborder hydropower plants

AIIB and IFC are considering a blended refinancing of the existing debt of three Xekaman hydropower plants in Laos.

Citizen Energy secures $1bn borrowing base facility

Citizen Energy has a signed a $1 billion reserve-based lending facility agreement with a syndication of banks.

SG and Santander provide €51m loan to Verkor in first-of-kind deal

In a first-of-its-kind deal, Societe Generale and Santander have arranged a €51 million facility backed by Bpifrance under its strategic project guarantee product.

Sullivan: Structured trade finance part 2

In the second episode of a two-part series on structured trade finance transactions, Sullivan partner Sam Fowler-Holmes and associates Natalie Lake and Maria Capocci consider key techniques for mitigating risk in trade financings, including structuring solutions and third party credit support. They also provide insight on how to handle additional risks that arise due to the nature of cross border financing.

Rare earths provide common ground for Australia and Germany

Germany and Australia are building a strategic alliance on the critical minerals supply front. As ever, the financing package and offtake agreements will prove the crucial elements for project success.

(1)[The A2Z survey participants included Aon Risk Services, Assetinsure, Axis Capital, BPL Global, Gallagher, GreenStars, BNP Paribas, HDI Global Specialty, Marsh, Howden CAP, Miller Insurance, Munich Re, Sovereign Risk Insurance, Swiss Re, Texel Finance, and WTW].