CIRR Reform: A roadblock to modernisation?

As part of the OECD’s latest package of updates to the Arrangement on Export Credits, a new methodology for the calculation of Commercial Interest Reference Rates has been published. Will the new terms deliver the promised benefits for exporters?

Has export finance been officially ‘modernised’ yet? Has the tipping point of modernity been reached as the industry looks to embrace digitalisation, green taxonomies and greater access for emerging markets? ECAs will need to prove that the reality matches the rhetoric when it comes to the detail of their new financing terms.

Export finance has often been hampered by perceptions; government institutions rarely achieve renown for their speed of transaction. Unfortunately, the OECD has done little to expunge this impression over the course of its long-winded and often fraught negotiations to update the Arrangement on Officially Supported Export Credits (the Arrangement). At least they offered further proof, if any were needed, that a gentleman’s agreement is a problematic method of arranging international relations.

Frustration has now given way to success and as of 15 July 2023 the newly modernised text has come into force. OECD ECAs will now be able to offer more flexible terms for climate friendly projects and the premium curve has been adjusted for longer tenor projects in regions with higher credit risk ratings. The scope of the Climate Change Sector Understanding has also been expanded.

July’s good news did not end there. The UK Electronic Trade Documents Act passed into law, giving certain digital trade documents the same legal status as paper. While this news is not specific to export finance, the industry will certainly benefit if banks and corporates can introduce greater efficiency and traceability in deal-making.

In the best news of all, TXF’s H1 Export Finance Data Report for 2023 reveals that volumes have soared to $82.8 billion. After a startlingly dynamic six months the industry is now just $10 billion short of surpassing total volumes for 2022. It is a vindication for the underlying resilience of the ECA product as well as its flexibility in the aftermath of the COVID-19 pandemic and the war in Ukraine. The community will rightly move forwards with real optimism.

Under the radar

Alongside the updates to the Arrangement, the OECD has now introduced a new methodology for the calculation of its Commercial Interest Reference Rates (CIRR). This news was revealed in January 2023 but the full detail only reached the public sphere in July and it was understandably overshadowed by reporting on the headline changes to the Arrangement.

CIRRs are the minimum interest rates on fixed-rate ECA loans, as stipulated under the terms of the Arrangement. They embody the spirit of the level playing field that the OECD looks to enforce between its members, while providing a haven from the volatility of floating interest rates.

As one banker familiar with CIRR-based transactions said to TXF, “CIRR is in high demand when liquidity is scarce and when there is a changing interest rate environment… it creates clarity and it is easier for the borrower to determine their repayments”. In this era of geopolitical and economic turbulence it should therefore come as no surprise that ECA products like CIRR are increasingly popular.

However, the new figures released on 15 July offered a few surprises. CIRRs have been raised across the board, effectively making ECA debt more expensive. Yet while this was no doubt unwelcome news for borrowers, a rise of a few basis points will not undermine the value of ECA cover.

A bigger problem lies in the CIRR reform text: “A commitment fee shall be charged for direct credits… Participants shall charge a commitment fee at or above commercial market practices provided that such information is available”. In other words, ECAs will now be able to charge a fee on the undrawn portion of a facility on top of the interest accumulated in the drawdown period.

The reasoning behind this change is not immediately clear. It has been suggested that the new methodology better reflects modern market rates while reducing inequalities between member states. The introduction of commitment fees also suggests that ECAs want to see a greater return on the risks they are absorbing in a high interest rate environment.

Commercial banks charge commitment fees because of the regulatory costs they incur on loan facilities. Critics will ask whether ECAs are exposed to similar risks. As Gabriel Buck, Managing Director at GKB Ventures, argues, “it is hard to imagine that such regulatory costs are ever applied to a government owned ECA”.

What seems clear is that, taken together, these CIRR reforms will add significant costs to borrowing. This comes after a period of severe supply chain disruption and high inflation, with cost overruns and soaring commodity prices causing damage to the viability of new projects. No exemptions have been issued, raising questions around the substance of the OECD’s modernisation agenda.

Buck sees this as a backward step for ECAs: “At a time when ECAs are presenting themselves as bastions of change for good, these changes are anything but… Any developing market borrower, any social infrastructure, any green or transformational project, any project in support of an export undertaken directly by SMEs; those four categories should be exempt from being charged commitment fees”.

Progress undermined as costs rise

The rhetoric from ECAs in recent months has been ambitious and confident. Certainly, the new modernisation package offers an opportunity to increase support for climate-friendly projects and deals in emerging markets. However, the progress made on long-term tenors and flatter premium curves will count for little if the headline cost of debt is prohibitive. There is no suggestion so far that commitment fees will be dropped if interest rates fall once again.

Ambiguity around the implementation of commitment fees could have its own impact. Sources have confirmed to TXF that UKEF will be charging a commitment fee. For buyer credit transactions UKEF will charge 30% of the CIRR margin, which is currently fixed at 100 basis points until 14 July 2024, or until the OECD can agree a new margin. A maximum margin of 120 basis points has been imposed, and since it will be based on five-year government bond yields, most currencies should expect to see the margin rise to that cap in the current economic environment.

Competition between exporters for new contracts is fierce, and much has been made of the flexibility on offer from non-OECD ECAs. An additional charge of 30 basis points could be the difference between success and failure on challenging projects in new technologies or high-risk regions. Of even greater concern is the possibility that OECD ECAs will begin to compete among themselves with different offerings on the CIRR margin.

While it is undoubtedly good news that export finance volumes are growing, a free-for-all in financing terms will not help to widen access to ECA products. If the OECD is serious in its new commitment to emerging markets, it must avoid uncertainty in the way it calculates fees.

This comes as demand for export finance continues to outstrip its capacity to provide. Mark Norris, Deputy Chair of the British Exporters Association (BExA) and a partner at Sullivan & Worcester, whilst welcoming the changes to the OECD Arrangement, in particular those changes to provide extra incentives for green and environmental projects, argues that more still needs to be done to introduce new companies to export finance: “CIRR-based financing is very attractive however if you're adding costs such as commitment fees that makes CIRR less competitive than it was. One thing we hear repeatedly is that exporters would like greater access to CIRR and concessional financing… Even if you make changes to the terms, if you can't access it because there is a limited pot, in some respects it then becomes academic”.

Concerns over the OECD’s reforms are, for the present, entirely speculative. The impact of the changes will only become apparent over the coming months and years, as more deals emerge. Given that the new reforms were only implemented last month, those discussions are still nascent.

However, it should be remembered that ECAs are faced with a rare opportunity. 2023 has already been a breakthrough year for the industry after a long period of strife and the tortuous negotiations in the OECD. Concerns have already been raised in some quarters around the absence of explicit terms for purely social projects as well as the consequences of extending deal tenors even further.

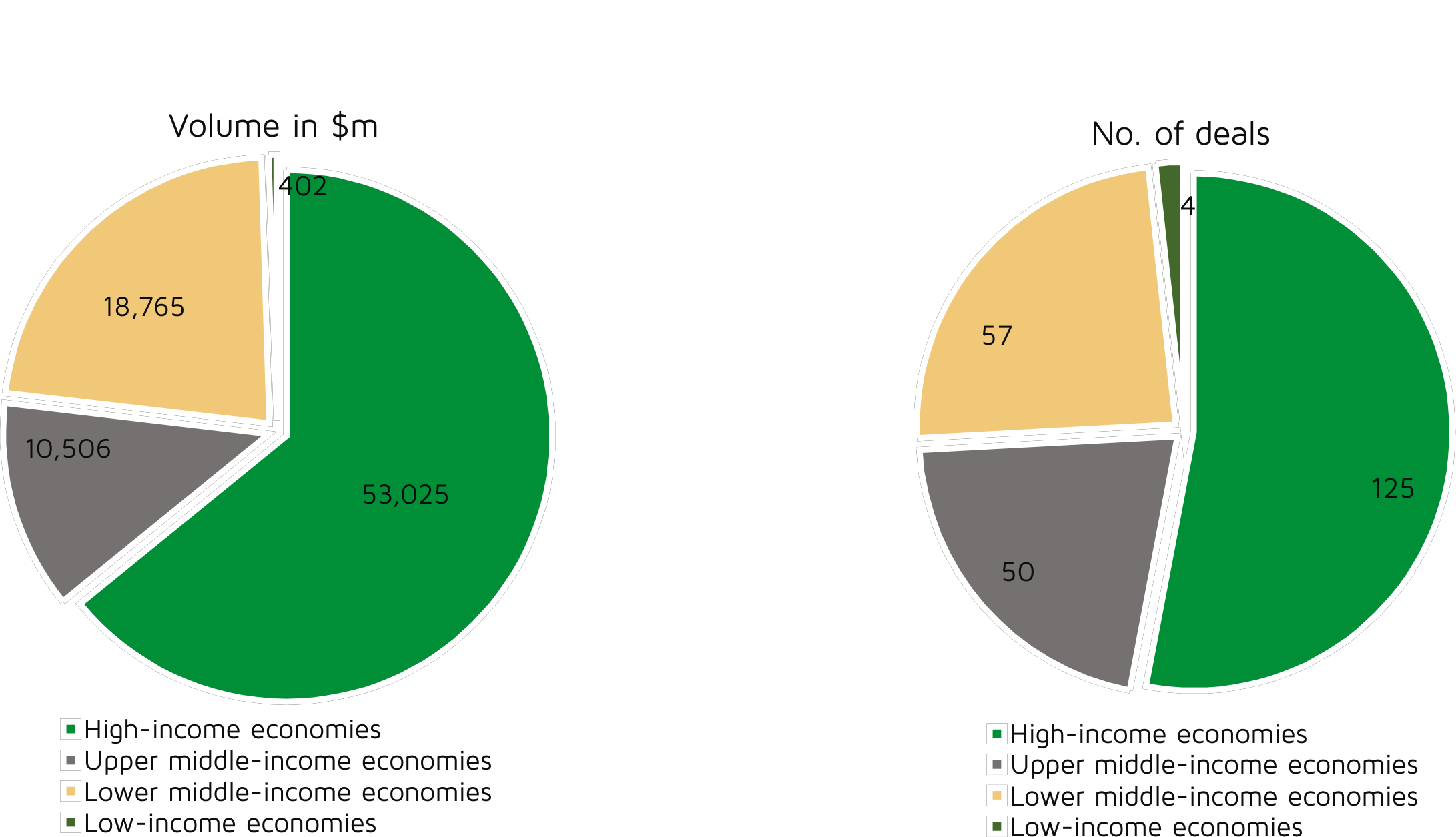

ECAs must prove that the new terms are sufficient to encourage greater deal flow in developing countries and in green sectors. TXF Intelligence’s export finance data report reveals that more than $53 billion out of a total of $83 billion has gone to high-income countries so far in 2023.

If the OECD has agreed a truly modern package of reforms, the proof will be in the pipeline.

Deals by World Bank country type H1 2023

Deals by World Bank country type H1 2023