LMA Syndicated Loans Conference 2023: shocks, crises, and reinvention

In an interview with Laurent Christophe, group treasurer at Trafigura, discussion focused on Ukraine, sustainability, and tapping into new sources of capital diversification. Some highlights from the interview and conference follow.

The war on Ukraine had a significant impact on the commodities industry and severely disrupted supply chains – Christophe said, "it was the largest commodity supply shock since the oil embargo of the 1970s", and it was all the more severe because of the correlation between many different commodities: gas, oil and metal prices "all went through the roof". He compared the liquidity crisis to the ‘global financial crisis’ from an intensity perspective for commodity traders, albeit with very different consequences.

For commodity traders, Christophe said the crisis required margin calls to be posted to the exchange and for brokers to increase the multipliers on initial margins – "which meant some billions of dollars out the door" and, for the company’s treasurer, "quite a lot of sleepless nights". Banking groups were able to provide liquidity to his trading company and the sector which did backstop what would have become a much more severe crisis, and shielded the economy from the worst.

Further impacts of the Ukraine situation included the numerous sanctions packages released by almost every jurisdiction which, he said, "reshuffled the cards of the industry". Trafigura had discussions with some regulators about the practical implementation of sanctions. As a borrower, Trafigura faced a conundrum which had not been envisaged in their facility agreements: paying a sanctioned lender would be a breach of sanction regulations but not paying a committed lender could be classed as a default event. Christophe said that the LMA does not yet provide a common language for a potentially sanctioned lender, but working sessions should hopefully address the issue.

Another trend which arose at the peak of the crisis was commodities traders beginning to tap ECA liquidity. The deals are topical not just from a trader perspective but also in terms of countries looking to secure access to key commodities to protect their domestic industries and economies: "What happened in Ukraine was really a wake-up call for the European economy about security of supply", noted Christophe.

These deals are now an important part of the traders' funding toolkit. However, Christophe also warned that not everyone can do these transactions: you need to have significant trade flows – "$3 billion, for example, is a lot of gas", he said – you need a strong balance sheet, and you need to have established ESG policies and credentials when dealing with government entities.

Commodities in the sustainable new world

When asked about the oil and gas funding gap, Christophe responded that traditionally around 75% of the equity or debt for new projects was raised on Wall Street and 25% came from alternative sources like dedicated natural resource funds and equity but today the reverse is true, he points out. To fill the gap, he says they are willing to enter projects as debt provider.

Still, he said, there are very few hydrocarbon energy projects and mineral developments being financed, yet "we’ve never been at a time when we have needed minerals more". Lithium, cobalt, nickel and copper are essential commodities for EV, battery, and renewables manufacturing, "they’re the way we can transition from fossil fuels to the next stage of the economy."

Regarding the energy transition, Christophe recognised that there was "some misunderstanding and skepticism about our industry – but, at the end of the day, we are critical for the global economy".

Africa and COP28

On the topic of reduced liquidity, elsewhere at the conference, Miranda Abraham of RMB argued that the window is not always available, so rather than sit on the sidelines waiting for pricing to improve, the more sophisticated borrowers should take liquidity when it is available.

With COP28 right around the corner in Dubai, there have been some significant sustainable UAE deals with Africa, such as the $450 million of carbon credit commitments from the UAE Carbon Alliance. But Tonmoy Andalib of FAB said: "ESG measures and responses are still mixed across the region". He said UAE leadership in particular are very ambitious in their targets and the banks and other leading institutions are following suit. FAB has a $70 billion sustainable finance target for 2030.

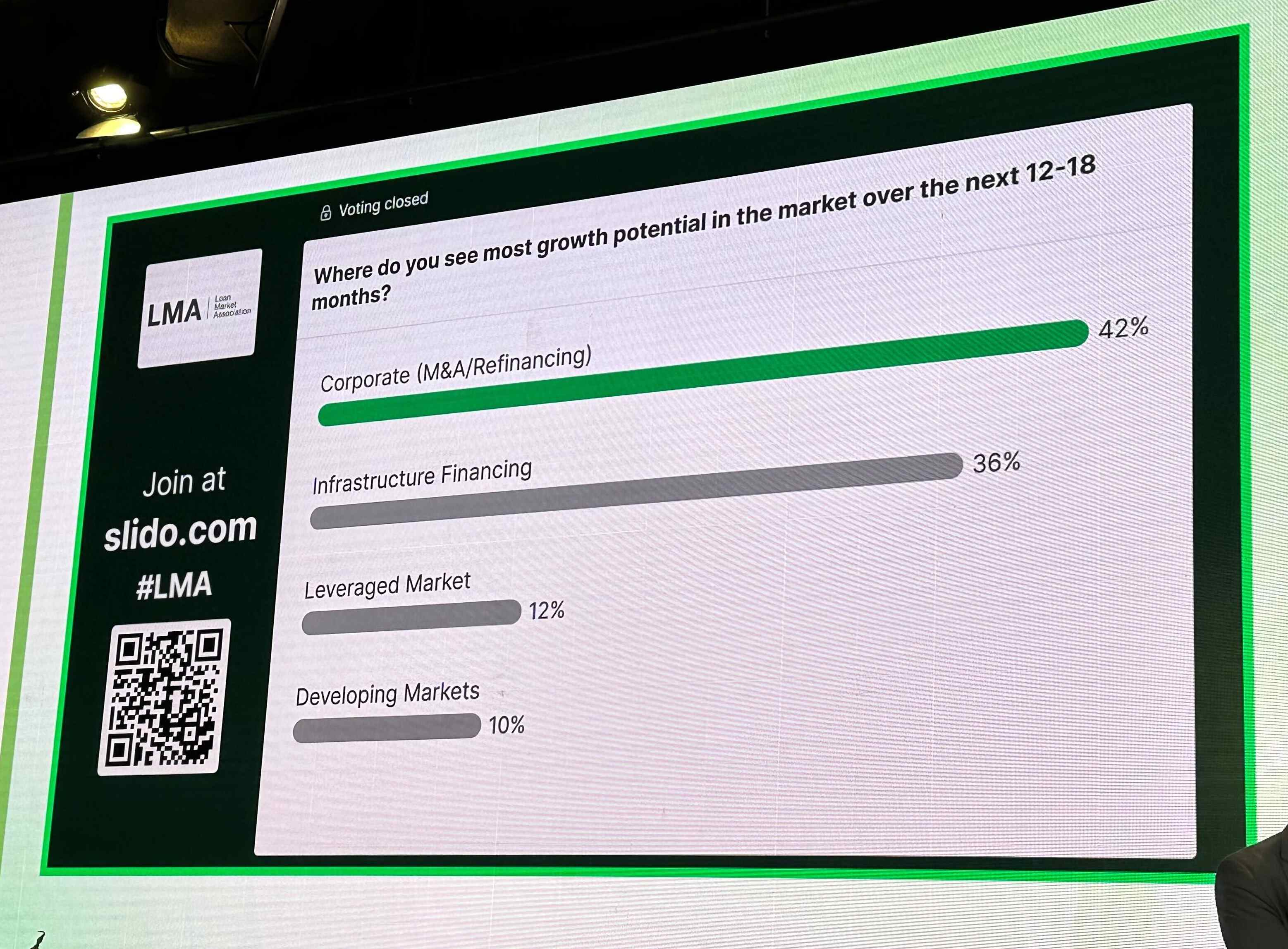

Back to work

Overall, there has been a decline in loan issuance this year, but a speaker from a European investment bank said next year is looking more positive: "H1 has been disrupted because of interest rates, supply chain delays, and the energy crisis – these issues are still here: the oil price is going up, inflation is high, supply chain issues have been addressed but have been replaced elsewhere, such as by wheat challenges. So why the uptick? Income needs to be created even if KPIs are not met". Ultimately, lenders concluded, it will be a case of "back to work".