Choppy waters prevail: TXF Commodity Finance Industry Report 2023

TXF Intelligence has published its Global Commodity Trade Finance Industry Report for 2023. Read on to find the latest analysis on a host of topical industry concerns, from the lack of investment in base metals to the rebalancing of agri/softs supply chains and the increasing role of export credit agencies in the commodities space.

The TXF Global Commodity Trade Finance Industry Report 2023 is available now for subscribers to TXF Intelligence. This report provides a unique and independent exploration into the key trends in the commodity finance industry over the past year. It utilises both qualitative and quantitative data gathered from banks, traders, producers, law firms, insurers and brokers through an in-depth survey and one-on-one interviews to present a thorough analysis of industry sentiment across all sectors and regions.

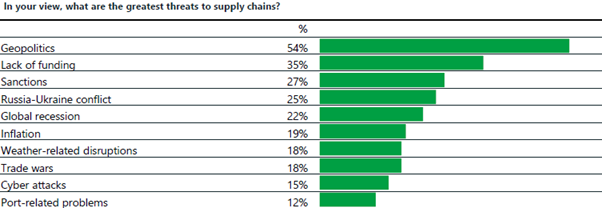

It should come as no surprise that the majority of respondents expressed uncertainty about the future of the industry. While forecasting has always been a dangerous game in commodities, the disruption of the last three years has been unprecedented. Consequently, 54% of respondents stated that geopolitics is the greatest threat to supply chains going forwards. Traders and producers must be flexible and reactive while the threat of sanctions still looms and oil prices will be held hostage to the unfolding impact of crisis in the Middle East.

With this in mind, it is important to note that traders and producers have been largely successful in adapting to new circumstances. Supply chains may be troubled, but the flow of commodities has continued unabated. The threat posed by growing tensions between China and the US is yet to be fully realised although every player in the industry should be prepared for trade fragmentation in the years to come.

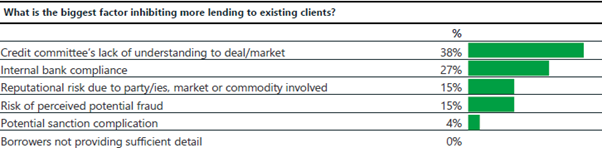

35% of respondents raised the issue of funding gaps in the industry, with one stating that “Banks have become extremely selective… What’s frustrating is that no one has really stepped in to plug this gap.” This flight towards the largest traders has bifurcated the industry between the haves and the have nots. Bank responses to the survey indicated that credit committees and due diligence procedures continue to inhibit the lending they can offer. It is also curious to note that fraud does not feature inside the top ten concerns listed by all respondents and is only fourth among the concerns listed by bankers.

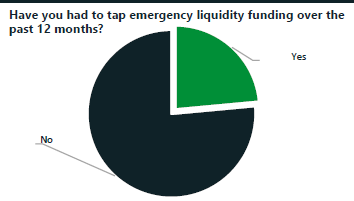

One quarter of corporate respondents had to tap emergency liquidity in 2023, while only 10% said that they do not have enough liquidity at present to meet margin calls. However, more than three quarters are diversifying their funding sources as they adapt to changing market conditions. This is no doubt also in response to the limited funding pool available from banks. A diverse range of alternative sources was recorded, from private credit and equity to loans from traders and family funds.

Turning to sector outlooks, 59% of the market sees oil as its most resilient commodity thanks to enduring demand. Prices will also be kept high by production cuts led by the OPEC group. Despite widespread concern for the pace of the energy transition, 55% of respondents predict little change in the trade of thermal and metallurgical coal next year.

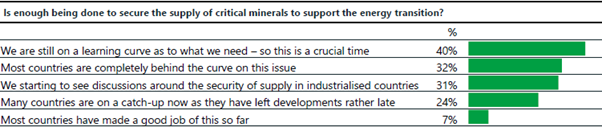

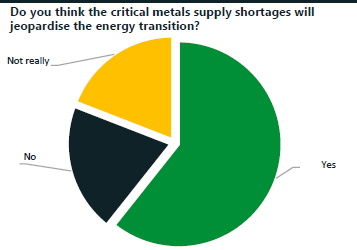

The metals and mining industry faces more serious challenges relating to underinvestment. 40% of respondents believe that the world is still on a learning curve in its approach to critical minerals, while an additional 32% feel that most countries are far behind the curve on this issue. A lack of investment appetite, political NIMBYism and short-term strategies were all cited as reasons for this. An overwhelming majority of respondents agreed that shortages in metal supplies will jeopardise the energy transition.

It is in response to this that ECAs have looked to step up their support for the metals and mining industry through a mixture of guarantees for commodity traders and financing for new mining projects. This development seems set to stay and while it is unlikely to resolve all of the problems in the supply of metal, at least it can be argued that governments are beginning to show leadership in the industry. Many investors and traders remain convinced that a heavy-handed glut of financing will result in years of oversupply that could do more harm than good.

Finally, the soft commodities markets have been hit hard by the shock of conflict in Ukraine and more than half of respondents feel that developing countries will continue to feel the effects of this. Ukraine’s role as a key grain producer for Africa and the Middle East has been well-documented, and Russia is taking full advantage of its control over seaborne export routes. Food supply chains are now heavily dependent on a handful of producer countries, not least Brazil. Climate change continues to wreak havoc on weather patterns that are essential to harvests around the world. Around 60% of respondents said that this disruption could potentially encourage producer countries to introduce export controls in future.

TXF thanks all those market participants who took the time to respond to our questionnaires and requests for interviews. As ever, TXF’s Intelligence team welcomes your comments and feedback on the report.

Dive into the TXF Commodity Finance Report 2023 for a deeper understanding of these, and many more, findings!

If you are an TXF Intelligence subscriber, login and access the report here.

If you are not currently a subscriber, you can request a copy of the report here.