Export finance trends of 2023: ECAs spearhead success amidst global challenges and geopolitical shifts

As we bid farewell to 2023, let's take a look at some of the key trends of the year, from adapting to OECD reforms to plugging the funding gap and championing collaboration... what will stick in 2024 and beyond?

The ECA model has evolved – with great success

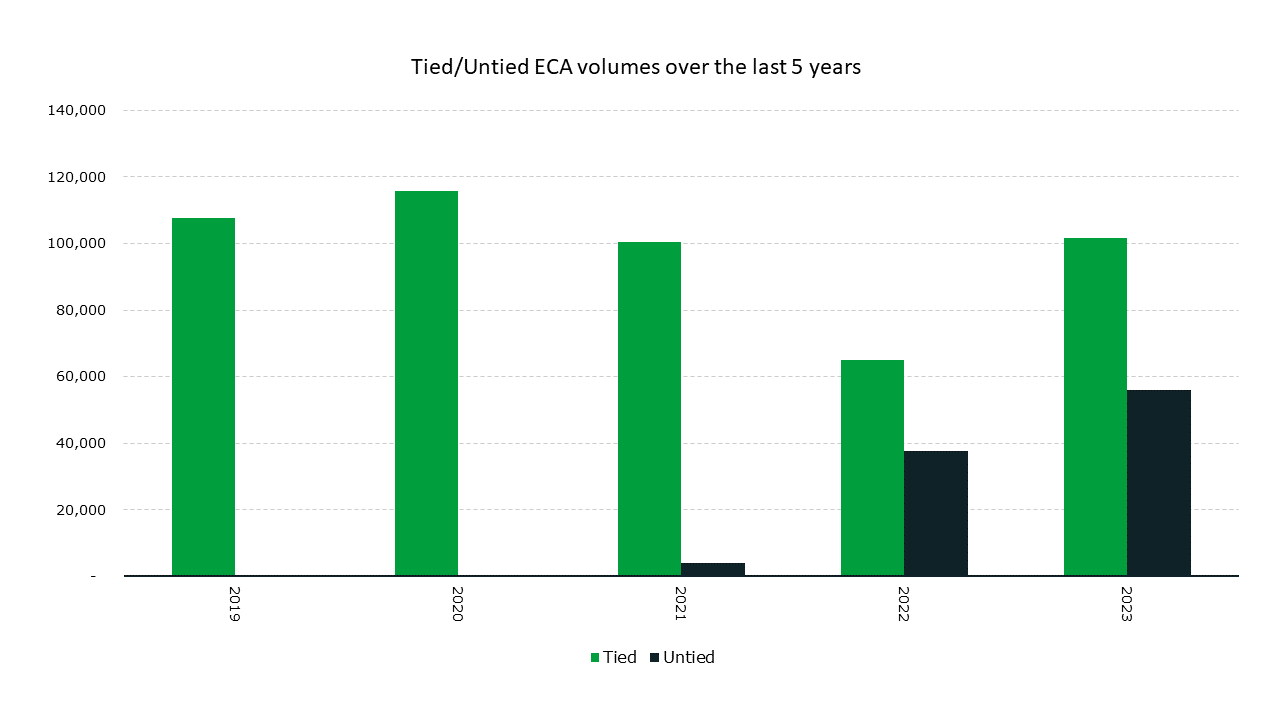

ECAs have looked to adapt their support for buyers and exporters in a high interest rate environment, revisiting and revamping older policies. The success of this evolution can be seen in the data – export finance is set for a record-breaking year. Greater flexibility brings diversification in financing instruments – the rise of untied support schemes for large corporates has continued with major new deals involving Trafigura, Siemens Energy and Gunvor. This has also given ECAs a prominent new geopolitical role. Realpolitik has driven ECAs into the world of energy security and they must now be more proactive than ever in their support for national interest.

OECD reforms have been welcomed by the market

Reforms to the OECD Arrangement on Officially Supported Export Credits arrived after years of negotiation and debate. While the impact of these changes will only be truly felt over the coming year, the market has reacted with optimism. Tenors for large-scale renewables projects have been pushed out to up to 22 years while most other projects can now go up to 15 years. The premium rate curve has also been adjusted for obligors with high credit risk ratings. These changes increase the affordability of the ECA product at a time of economic turmoil. However, questions remain: how will ECAs balance their portfolios as longer maturities become the norm? Should the Arrangement set a common position on support for fossil fuel projects?

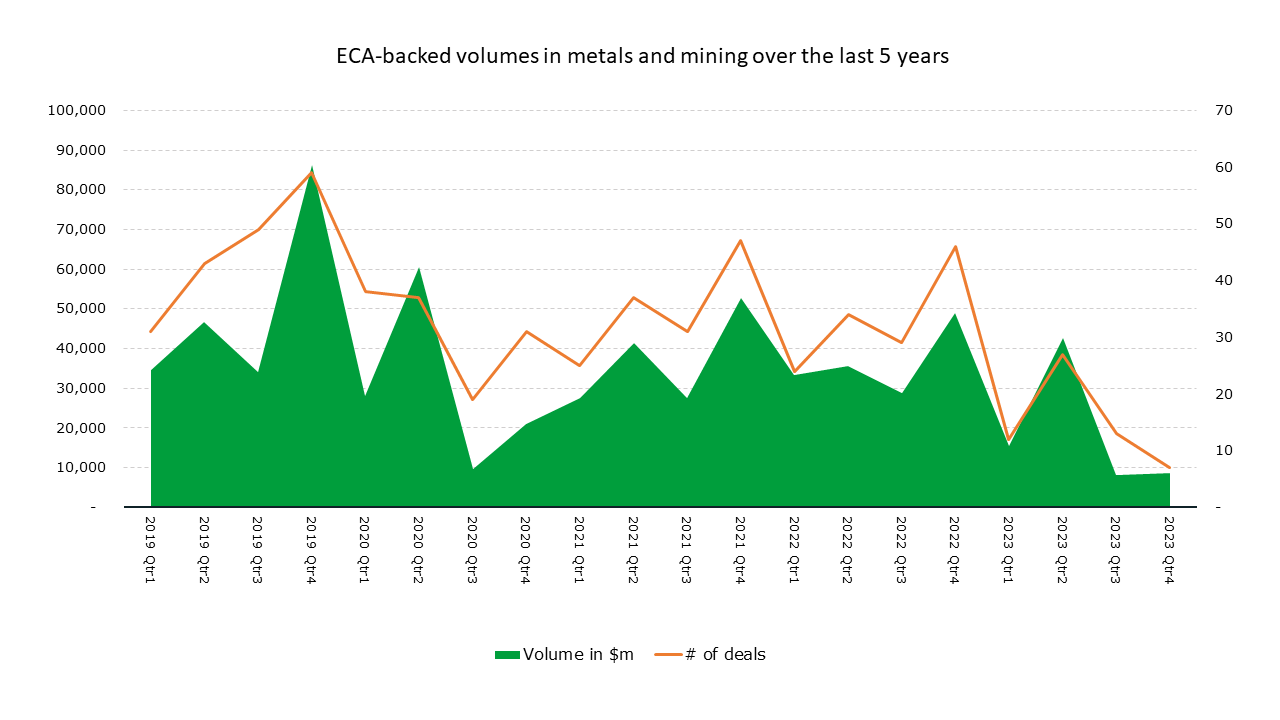

Can ECAs plug the funding gap as critical minerals make headlines?

The phrase ‘critical mineral’ has now become standard parlance as countries look to secure the green energy transition with a steady supply of metal. However, the mining industry continues to suffer from a chronic lack of investment.

ECA financing is increasingly available for projects that are deemed significant for national security. Over the course of 2023 ECAs supported several project financings including the Kathleen Valley lithium deal and the Hybar rebar steel mill facility. Expect to see this deal flow rise over 2024 if ECAs can make good on their expressions of interest. Talks are under way for three new mines led by Cerrado Gold, while BNP Paribas will lead the financing for Vulcan Energy’s zero-carbon lithium project.

Collaboration between financial institutions is on the rise

Financial institutions are now championing collaborative approaches to dealmaking, encouraging alliances and reinsurance frameworks. Increased cooperation and a more holistic approach can be an enabler for big-ticket project finance in challenging markets. Look no further than the Syrdarya II CCGT project in Uzbekistan, led by NEXI, JBIC and the IFC, or the recently signed Baltic Power project. The challenge now is to show that memorandums and agreements can be turned into deal volume. ECAs and DFIs are not often praised for their speed of execution but on the evidence of recent years, necessity can bring about rapid change.

Watch the TXF highlights of 2023 video!