Commodity finance trends of 2023: Geopolitical shadows, funding challenges, and transparency struggles

It's time to reflect on the notable trends that defined the year that was 2023 - ranging from geopolitical risk, funding options, sustainability and trader transparency. Looking ahead to 2024 and beyond, what trends are poised to endure?

Geopolitical risk continues to cast a shadow

Geopolitical tension has made long-term planning in the commodities industry effectively impossible. Supply chains have largely adapted to the impact of the Russia-Ukraine war, but the agri-trade in particular is now dependent on a handful of producer countries. Sanctions remain in place but a ghost fleet continues to ship Russian energy to export markets. The threat of trade fragmentation remains high. China’s relationship with the US receives significant media attention, but the role of resource nationalism is arguably just as important. Major commodity producers in Asia, South America and Africa are beginning to impose greater controls over their commodities. Traders and financiers are operating in a heightened risk environment that seems set to stay.

A funding puzzle with fewer and fewer solutions

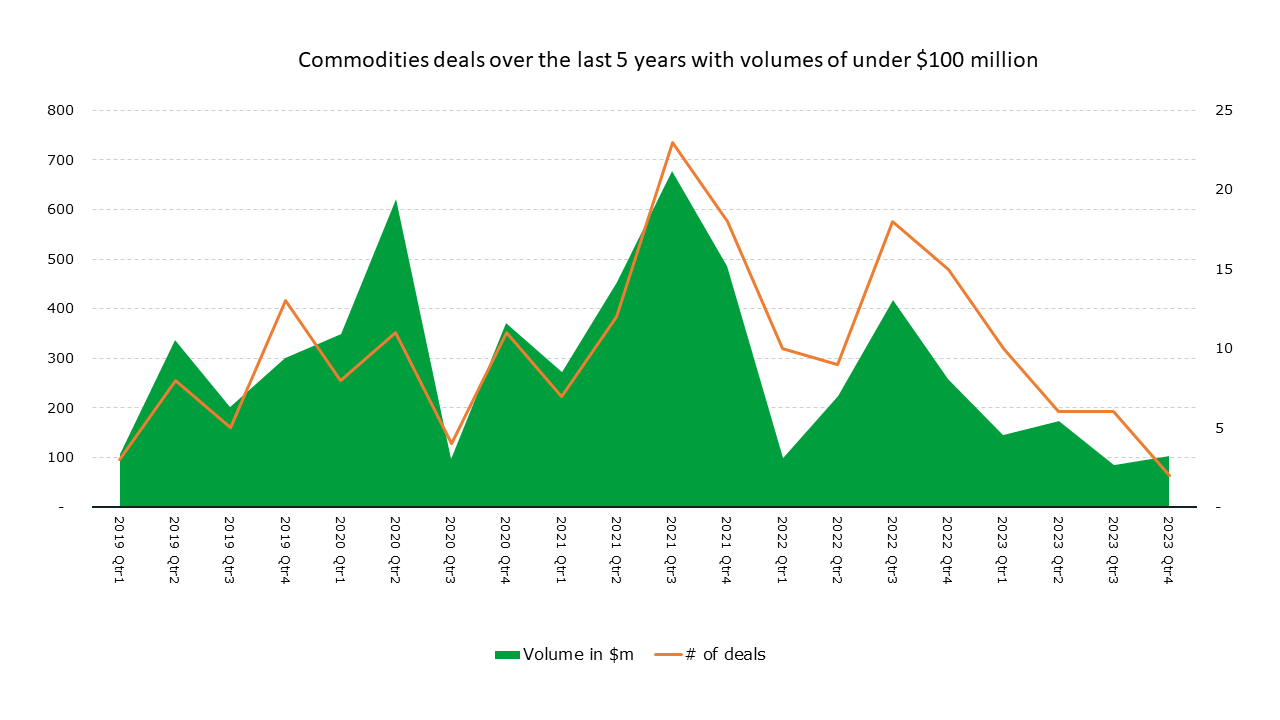

Bank financing is seemingly plentiful for the largest traders, but smaller players must seek alternative funding options. Trafigura can secure oversubscribed facilities with tightened pricing while banks argue that compliance procedures and onboarding costs prevent them from expanding their offering. The number of commodity finance deals with volumes under $100 million has flatlined over the course of 2023.

One unspoken factor behind this decline is the fact that banks struggle to make large profits from small-scale financing. The industry’s fraud risks and transparency issues continue to push financiers towards size. There has been a significant increase in ECA-backed debt for commodity traders, with a total volume of $16.4bn so far in 2023. This convergence offers traders a new source of debt and greater access to exporters in need of critical commodities. However this won’t solve the funding crisis in the industry – ECA finance has so far been limited to the same pool of trading giants.

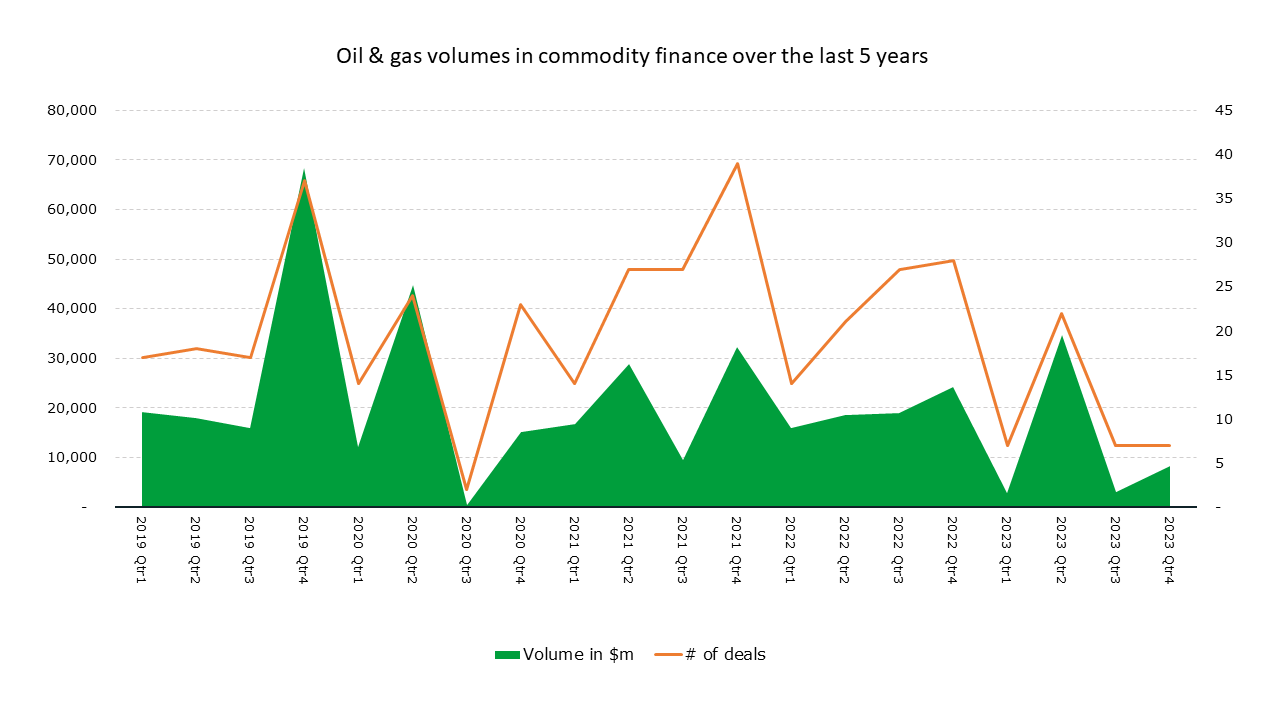

Sustainability makes progress but fossil fuel demand is set to stay

Sustainability is at the forefront of the industry, but oil & gas is expected to remain the most profitable asset class. Demand for fossil fuels will continue to drive trading activity. Carbon credits have created headlines, but uptake remains relatively low across the industry. By contrast sustainability-linked loans are now utilised widely to incentivise sustainable development. The release of the LMA’s model provisions for SLLs will aid standardisation and regulation.

Traders grapple with transparency challenges

The fallout from Trafigura’s missing nickel cargoes has emerged slowly, but a clear lesson is that commodity traders still struggle with transparency. There is a clear gap between rhetoric and reality at present. While fraud cases are still few and far between, they have an outsized impact on financing – it is only three years since fraud forced the withdrawal of two major lenders from the industry.

Watch the TXF highlights of 2023 video!