Girteka pens ECA-backed financing for fleet renewal

Lithuanian transport and logistics company Girteka has signed a €74 million (about $87 million) ECA-backed financing with AKA Bank...

- Leslie Maruzira, BAM Nuttall

Whether you're a novice or experienced professional, our comprehensive and highly acclaimed ECA Finance boot camp provides a core understanding of ECA Financing, plus a thorough examination of the entire process of completing a successful export finance transaction.

In partnership with CC Solutions, the 2-day course introduces the practical and theoretical elements of different products, policies and applications with real-life examples from senior professionals. So you get focused information which you can apply directly in your role. Please note the training takes places in English.

WHO SHOULD ATTEND AND WHY?

Lenders/ ECAs/Financial institutions/Financial Advisors | To gain a greater knowledge of rules & requirements, how to avoid common pitfalls and misunderstandings that can strain relationships with customers

Exporters/Suppliers/OEMs/EPCs | To understand how ECA finance impacts the EPC process from RPFs through to procurement cycle, learn how to accurately assess eligible content for your buyers, and avoid costly problems during the spend cycle that relate to misunderstanding eligibility.

Corporates/Sponsors/Borrowers/Sovereigns | Understand the approval process, compare eligibility requirements among ECAs, study how to maximise ECA financing value, and grasp the myriad tasks necessary to effectively disburse and administer these transactions.

Legal teams | To understand the impacts of ECA financing on credit agreements and be able to better advise clients on compliance as well as understand potential problems commonly found in ECA transactions.

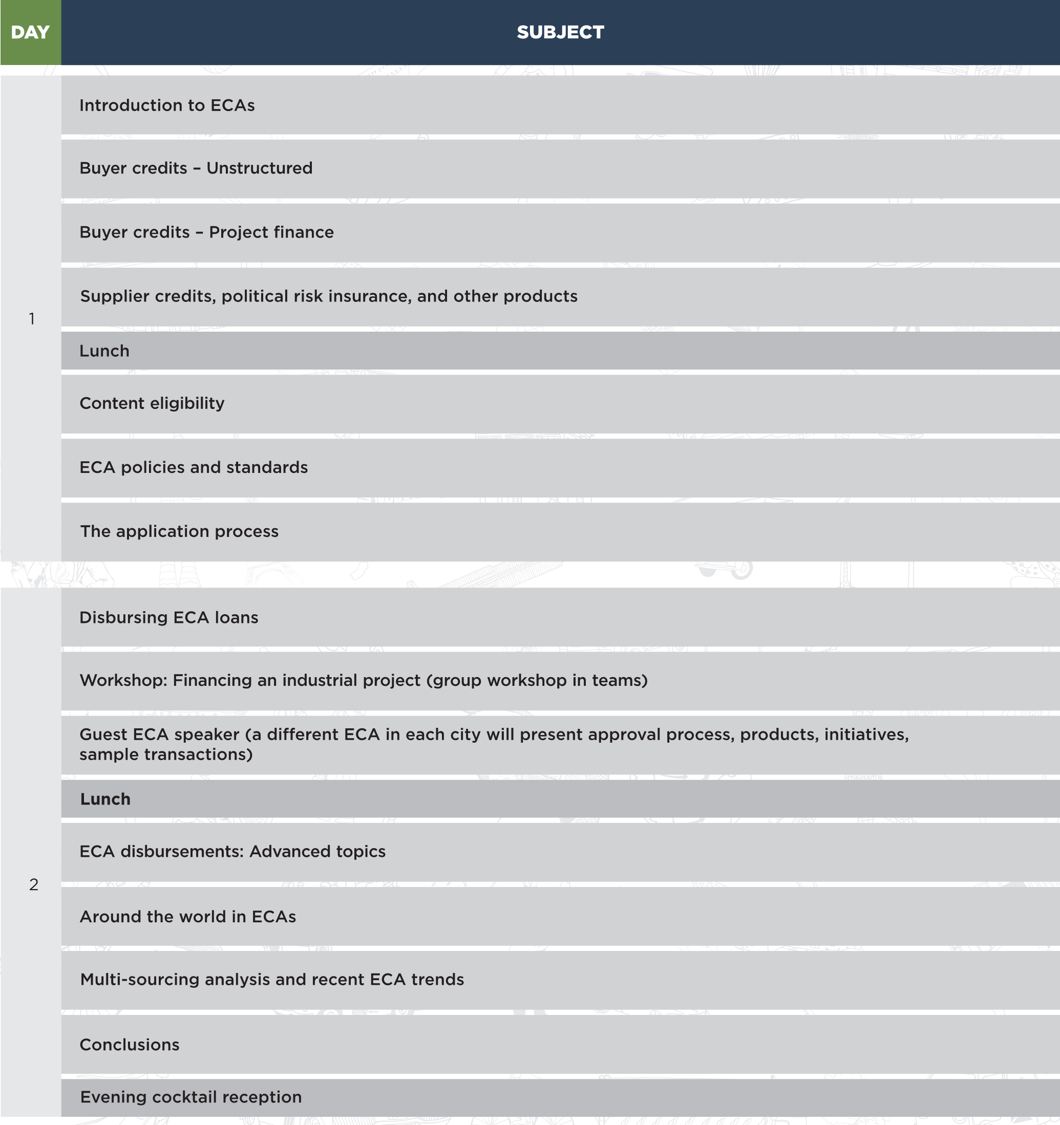

Please find the course breakdown below. If you would like more detail, please contact lucy.morris@txfmedia.com who can put you in touch with one of our expert course leaders.

We have various dates and locations around the world you can choose from:

Prague, 4 & 5 June

Prague, 4 & 5 June

Hong Kong, 9 & 10 October View website/ book

Hong Kong, 9 & 10 October View website/ book

PLUS more dates and locations will be added shortly!