TXF data update: Structured commodity finance makes a comeback

Commodity finance markets in 2016 were a myriad of regional shifts, structuring changes, and price fluctuations. Russia and North America demonstrated a resurgence while commodity price drops led to greater structured financing needs out of the Middle East.

Global commodity finance volumes have increased to $134 billion in 2016, up from $113 billion in 2015, according to TXF’s Commodity Finance Data Report for 2016.

The increased volume corresponds with an increase in structured commodity finance (SCF) year-on-year, spurred by the revival of key producing regions such as Russia and the Commonwealth of Independent States (CIS). The usage of PXF structures rose by 43% on 2015 with slightly lower loan pricing giving producers greater incentive to bank secured financing.

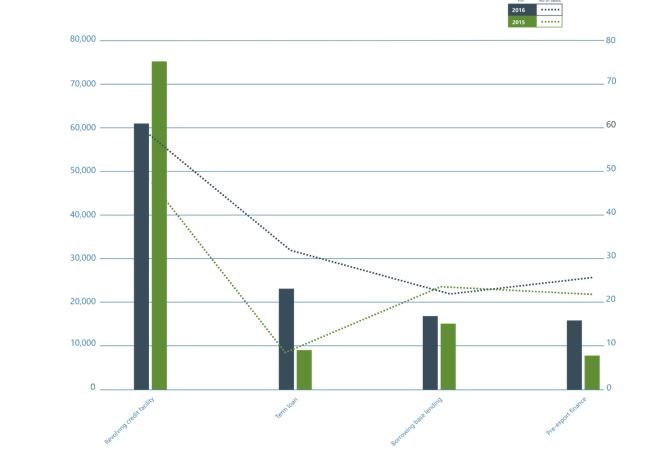

Revolving credit facilities (RCF) remained the most used facility in 2016 covering 47.6% of the market, although that is a significant drop from 65% in 2015. The drop in usage was despite the total number of RCFs in 2016 increasing by 13.

As Ian Henderson, senior portfolio manager at Gulf International Bank, tells TXF: “RCFs tend to be used by a particular class of traders who have been using them for a long time and has become an established structure within the market for banks who have taken them onto their balance sheet. However, given the look of the bond market in recent years some traders will have looked to find better tenors and pricing from the capital markets.”

The suggestion is that smaller and medium-sized traders have moved away from RCFs into bonds or more structured financing. It is also a product of banks’ compliance and risk committees adjudging more scrutiny to the RCF structure when apportioning costs.

Borrowing bases were also more heavily utilised in 2016 and remained the most used form of SCF. However, the structure is changing and lenders may well be more cautious in the future as terms have loosened when they would prefer them to be tighter.

Russia returns?

2016 was notable for the resurgence of Russia and CIS in the commodities space. TXF Data for H1 showed the region’s deal volume was up and this continued throughout the rest of the year. The size of Russian CIS facilities increased by 60% from $5.7 billion in 2015 to over $15 billion in 2016.

As a result, Russian producers were the highest recipients of bank debt in 2016 of any region in the world taking 26.7% of the market, more than Europe which was second with 25.4%.

As Henderson notes: “Commodity flows out of Russia have continued and a number of producers have gone back into the PXF structure with international banks who are more comfortable with that facility. The value of these PXFs is a corollary of commodity prices which have picked up in the metals space hence greater usage.”

Improvements across H2 2016 in key commodities such as steel, copper, zinc, and nickel aided producers and exporters, though the average tranche size on these deals also decreased by $100 million year-on-year.

This correlation is also true of the Middle East where the low oil price led to a lack of domestic liquidity forcing companies to access foreign banks for their working capital needs. Previously this revenue would have come from oil volumes, but corporates were forced to use structured facilities, some for the first time, to raise debt in 2016. Consequently, the Middle East generated almost ten times as many loans to producers in 2016 as in 2015, and become more important in terms of PXF structures for oil and gas and partly in softs.

Asia-Pacific was the third biggest region for traders’ bank debt with 18.7% ($14.38 billion) a $4 billion increase on 2015’s total. However, the region was pushed out of second place despite the increase following a huge year for trader debt in North America. This is partly due to the emergence of the US as a location for large working capital financings for commodity traders. Deals such as Gunvor USA’s $500 million borrowing base and Noble Americas’ $3 billion financing (RCF and borrowing base) helped grow the region to $22.93 billion in total financing debt in 2016, though still some way behind Europe on $36.05 billion.

One financier believes the increase in debt to traders in North America is a product of needing to access different pools of liquidity to make their dealings more cost effective. Factors such as a re-interpretation of Chinese demand dynamics and greater access to energy resources such as LPC and LNG out of the US have fuelled the region’s resurgence. It is also partly down to banks in the US and EU being reluctant, for ethical and/or environmental reasons, to finance coal transactions.

Expansion into the US is a key part of the market and more deals are being booked there as more parties expand there. There is clearly room to grow given even big names like Gunvor only set up operations there last year.

TXF will be examining these trends in more depth at TXF Amsterdam 2017, its flagship conference for the commodity finance and natural resources industry. For more information, see the event page.

While TXF Data is an ever-growing source of information on deals and trends out of the commodities space, it does not claim to be comprehensive and is indicative of the detail provided to us.

To download the full report click here or contact dkloiber@tagmydeals.com