Basel III: The impact of sovereign risk debts on banks and ECAs

The Basel Committee published a discussion paper earlier this month on the regulatory treatment of sovereign exposures. The review raises some very important questions for banks and the wider export finance community.

Earlier this month the Basel Committee on Banking Supervision published a discussion paper on the regulatory treatment of sovereign exposures, with a number of recommended policy options.

The review opens the door to major changes such as:

- The compulsory recourse to the standardised approach to calculate risk-weighted assets (RWA) and hence equity linked to sovereign exposures;

- The introduction of positive RWAs for all sovereign exposures (instead of 0%);

- The introduction of additional RWAs for exposures in other currencies than the domestic one;

- The introduction of additional RWAs for exposures on sovereign entities other than the central government.

For an ECA, the most import question is whether the ECA is defined as a ‘sovereign entity’ or an ‘other sovereign entity’. There is a significant disparity between the applicable minimum RWA, with much higher RWA requirements for ‘other sovereign entities’, as well as ECA loans in foreign currencies.

“In short, the Basel Committee is distinguishing between the national treasury and other sovereign entities, and thus if ECAs are classified as ‘other sovereign entities’ there might be a detrimental impact on the RWA,” Henri d’Ambrieres, at HDA Conseil, tells TXF.

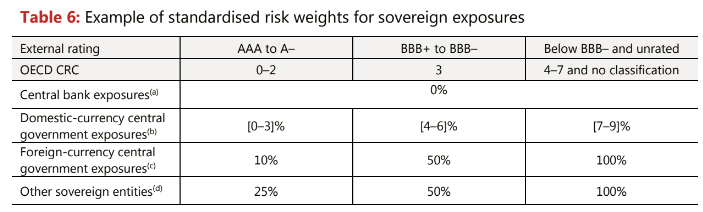

The proposed regulation introduces minimum RWAs, instead of 0%, for sovereign exposures. For domestic currency central exposures in a BBB+ to BBB- country, the regulation would introduce a minimum RWA of 4-6%, and 0-3%, for AAA to A- countries, whereas foreign currency central government exposures would be subject to minimum RWAs of 50% and 10%, respectively (see table 6).

ECAs will be hoping for categorisation under central government, as ‘other sovereign entities’ could be exposed to a standardised risk weight of 25% for AAA to A- countries and 50% for BBB+ to BBB- countries. Thus, if ECAs were to be classified under this category, commercial banks looking to tap export finance would be dealt a significant blow as a result of the higher RWA requirements.

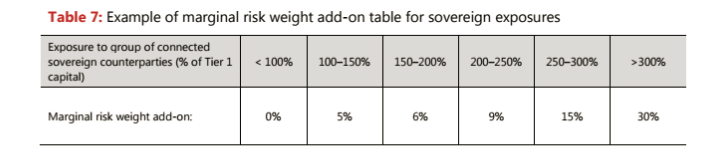

Likewise, page 33 of the discussion paper, provided some interesting examples of how marginal risk weight add-ons would be calculated for large sovereign exposures (see table 7). The question is what will be the impact of this add-on on RWAs?

The paper states that ‘this threshold was set at 100% which broadly represents the average requirement for bank’s high quality liquid assets (HQLA) holdings to meet the liquidity ratios’.

“Normally, the theory is that a bank should not add an exposure on an entity which is more than 25% of its equity - this is a basic principle of the diversification of risk. Currently there is no limit for sovereign loans,” say D’Ambrieres. "In Europe, sovereign debts can represent up to 200% of the equity of some banks and banks hold 20-25% in sovereign debts."

As export credits do not qualify as HQLA, the cost of additional holdings on sovereign debt might lead banks to limit their export credits, even though ECA cover relates to guarantees to commercial loans which seldom default.

While the revision of Basel III has raised several long-term questions for commercial banks using export finance, there have been no amendments on sovereign exposures since 2004. D’Ambrieres concludes: “When we first spoke about Basel III, decisions were made 10 years before implementation. The introduction of these regulations could take years but have to be anticipated.”Comments on the paper are due on 9 March 2018.