In the land of the blind, the one-eyed man is king: The opaque world of international trade

Baldev Bhinder, managing director of Singapore-based law firm Blackstone & Gold, explores how the opaque nature of paper-based trade finance can leave the door wide-open to mis-representation and even fraud.

- International trade is increasingly turning on the leverage available in monetising credit positions through the use of paper documentation.

- Fragmented information gaps, overreliance on paper documentation and a lack of a central repository provides an environment in which synthetic trades and fraudulent multiple financings can occur.

- Large scale adoption of blockchain technology to eradicate trade fraud may still be a while away.

Statistics will proudly boast that international trade is valued in the trillions of dollars each year. This is the world of international trade where invoices, warehouse trust receipts and bills of lading are exchanged between producers and end users of essential commodities such as grains, metals and oil. These bits of paper are passed through numerous hands before reaching the end users as traders and their banks place themselves in the trade flow adding multiple layers of liquidity on a single cargo. This world of documents, solely reliant on the purported truth of the representations contained on its face, is blind to the world of the physical movement of goods.

The two worlds are disjointed, moving at different speeds and involving different actors, creating the potential for synthetic trades or sometimes even fake trades. The prevalence of multiple financing cannot be understated: for every high-profile trade fraud case such as the Qingdao scandal in 2014 and Access World in 2017, there are numerous others handled in private arbitrations by lawyers like myself. With the wheels of international trade turning increasingly on monetising documents rather than goods, what more can be done to shed some light on the murky world of paper shuffling in international trade?

What is the problem?

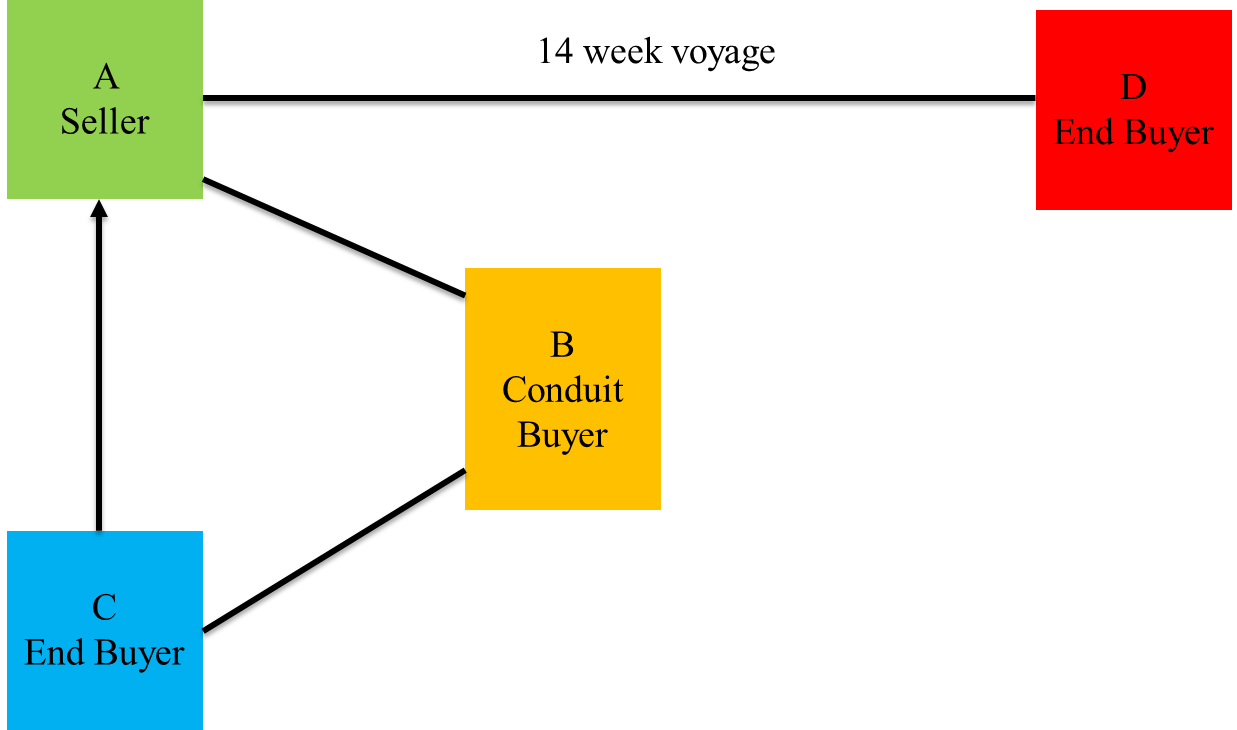

With an increasingly connected world wiping out arbitrage opportunities on price margins, traders have turned to structuring their trades to leverage on credit positions to create margins. Documents such as a bill of lading or a warehouse receipt are treated as title documents to the goods. These documents are then used as security or monetised for credit terms from other buyers or borrowing facilities from banks. Put another way, credit is effectively the new commodity and the underlying goods are just ancillary. But the shrewd trader knows a better way of making money – the trader can ‘roll’ these title documents such that these documents are monetised through a string of buyers before returning to the original seller. Diagram A provides an example of how a circular trade is carried out on paper while physical goods are moving to a completely different end buyer.

Diagram A: Circular Trade

In a voyage between West Africa or South America to Asia (which consumes a significant proportion of global commodities), a trader has several weeks to ‘roll’ its title documents. With a warehouse receipt, the lead time is months. As long as the title documents are returned before final delivery to its final buyer, no one is the wiser of this synthetic sub-trade. The opportunity and indeed the reward to multiple finance the same cargo, couldn’t be greater. Revenue is booked across the string of buyers, banking lines utilised – everyone is a winner in this game of musical chairs. As long as the music keeps playing.

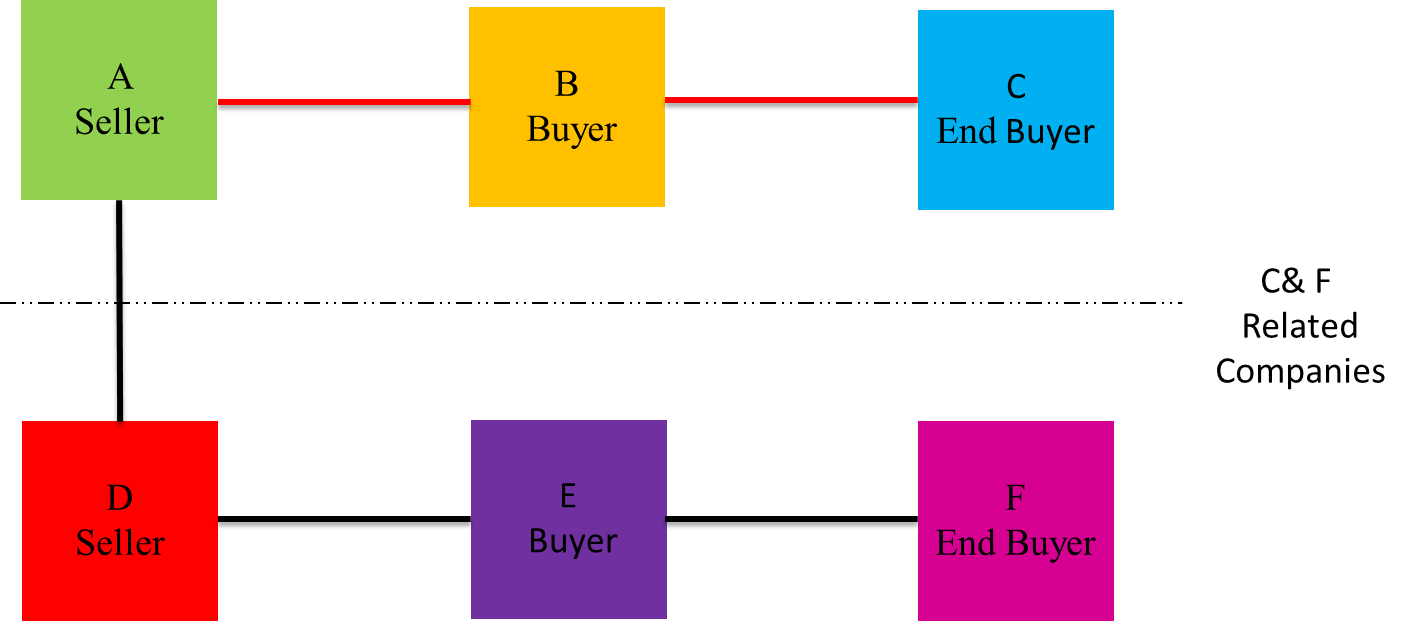

But every now and then the music stops because there is a liquidity crunch, typically when a trader overleverages itself. After the smoke has settled and the mirrors broken, we find some bewildering trade flows with the banks caught blind, holding on to worthless title documents that have been duplicated numerous times over. With fake title documents, a phantom trade can be created in parallel to a real trade using the same details of an actual voyage but with different buyers. By the time, this ‘mirror’ trade is detected, the cargo is often untraceable or consumed leaving different banks to the realisation that they have all financed the same cargo. (see: Diagram B)

Diagram B: Mirror Trade

Why does it happen?

The short answer as you can expect, is that trade fraud generally happens because of a desire to create liquidity rather than as an orchestrated master plan targeted at specific companies.

At the heart of multiple financing, lies three key ingredients. First, there must be credit, typically in the form of multiple lines of financing through numerous banks all of which are unable to identify if they are lending for the same cargo due to a combination of a lack of a central repository and traditional banking secrecy laws.

Second, title documents like bills of lading continue to exist predominantly in physical paper form. A ‘negotiable’ bill of lading often used in trade effectively operates as a blank bearer cheque as the buyer’s name will be deliberately left empty to facilitate negotiation to any third party. Given the ease of which a party can manipulate the information on a bill, it astonishes me that banks are still in the practice of lending money off the back of copies instead of originals of such documents.

Third, there needs be a string of traders involved each sat in different countries to exploit fragmented information gaps. As bills can be manipulated easily, each pair of hands it passes through increases the risk of fraud. Add to that, a few of the world’s largest trading houses and trading banks into the chain and a phantom trade now gains credibility.

Surely, if the documents have passed through these large institutions, they must be legitimate? Too much comfort is placed on the documents if they pass through these institutions and not enough scrutiny on how these documents originated in the first place. A large institution in a phantom trade flow is instrumental as it serves to deflect attention -- for an easy margin these institutions can unwittingly give a phantom trade a veneer of legitimacy. The smoke and mirrors are now in place.

The solution

With banks and insurers losing astronomical sums in multiple financing cases, is there a solution in sight? Blockchain with all its potential has yet to change this facet of international trade. Yes, there have been numerous platforms created based on the fundamental blockchain technology of an immutable distributable ledger so that a single cargo cannot be tacked twice by users on the platform. Unfortunately, therein lies the biggest challenge with blockchain – for it to reach its full potential to eradicate multiple financing, it will require a significant amount of participation from the world’s trade finance banks and trading houses.

The difficulty is that there will always be traders and banks that will conduct trade finance outside the system and as long as that parallel system is in operation, the world of international trade will remain murky. Instead of waiting for blockchain to change international trade, a better approach would be for banks and traders to spend more time on the transaction due diligence than being distracted by easy margins.

If you would look hard enough, the signs will often be there.

About the author

Baldev Bhinder is the managing director of Blackstone & Gold, a Singapore-based law firm specialising in energy and commodities. Baldev has spent a significant amount of his career involved in international trade disputes and is recognised as a leading arbitration lawyer by the world’s leading legal directories.

He can be reached at baldevbhinder@blackstonegold.com